Ontario Support for Families portal is LIVE!

/in 2020 Only, Blog, Coronavirus, Ontario Only/by Financial Tech ToolsToday, Ontario launched the portal for parents to apply for a one-time COVID-19 payment to help offset the costs of keeping children entertained and engaged during this time away from school.

Under this new program, parents are eligible for a one-time per child payment of:

-

$200 for children aged 0 to 12

-

$250 for children or youth aged 0 to 21 with special needs

Eligibility

There is no income cap on this program. All parents are eligible if you have a child who is:

-

$200 for children aged 0 to 12

-

$250 for children or youth aged 0 to 21 with special needs

If you have more than one child, you must submit one application per child.

Before you apply, please note:

-

only one parent can apply for each child

-

the parent who applies should have custody of the child

You are still eligible if you are a health care or front-line worker who is using emergency, 24-hour child care centres.

Accepting Applications starting April 6th – Canada Emergency Response Benefit (CERB)

/in 2020 Only, Blog, Coronavirus/by Financial Tech ToolsThe sheer volume of applications for the Canada Emergency Response Benefit (CERB) will likely overwhelm the system. If you or someone you know need to apply for this benefit, we suggest you prepare TODAY before the applications begin:

-

Double check your myCRA account username and password

-

Direct Deposit is setup

-

3 – 5 days via Direct Deposit vs 10 days via cheque in the mail

-

You should double check your myCRA username and password by signing in at:

If you do not have direct deposit setup with CRA, you can set it up TODAY at:

To help manage the volume, the CRA has setup specific days for you to apply based on month of birth.

If you were born in the month of:

-

January | February | March: Mondays – Best day to apply is April 6th

-

April | May | June: Tuesdays – Best day to apply is April 7th

-

July | August | September: Wednesdays – Best day to apply is April 8th

-

October | November | December: Thursdays – Best day to apply is April 9th

-

Fridays, Saturdays and Sundays are open for any birth month

Eligibility

The benefit will be available to workers:

-

Residing in Canada, who are at least 15 years old;

-

Who have stopped working because of COVID-19 and have not voluntarily quit their job or are eligible for EI regular or sickness benefits;

-

Who had income of at least $5,000 in 2019 or in the 12 months prior to the date of their application; and

-

Who are or expect to be without employment or self-employment income for at least 14 consecutive days in the initial four-week period. For subsequent benefit periods, they expect to have no employment or self-employment income.

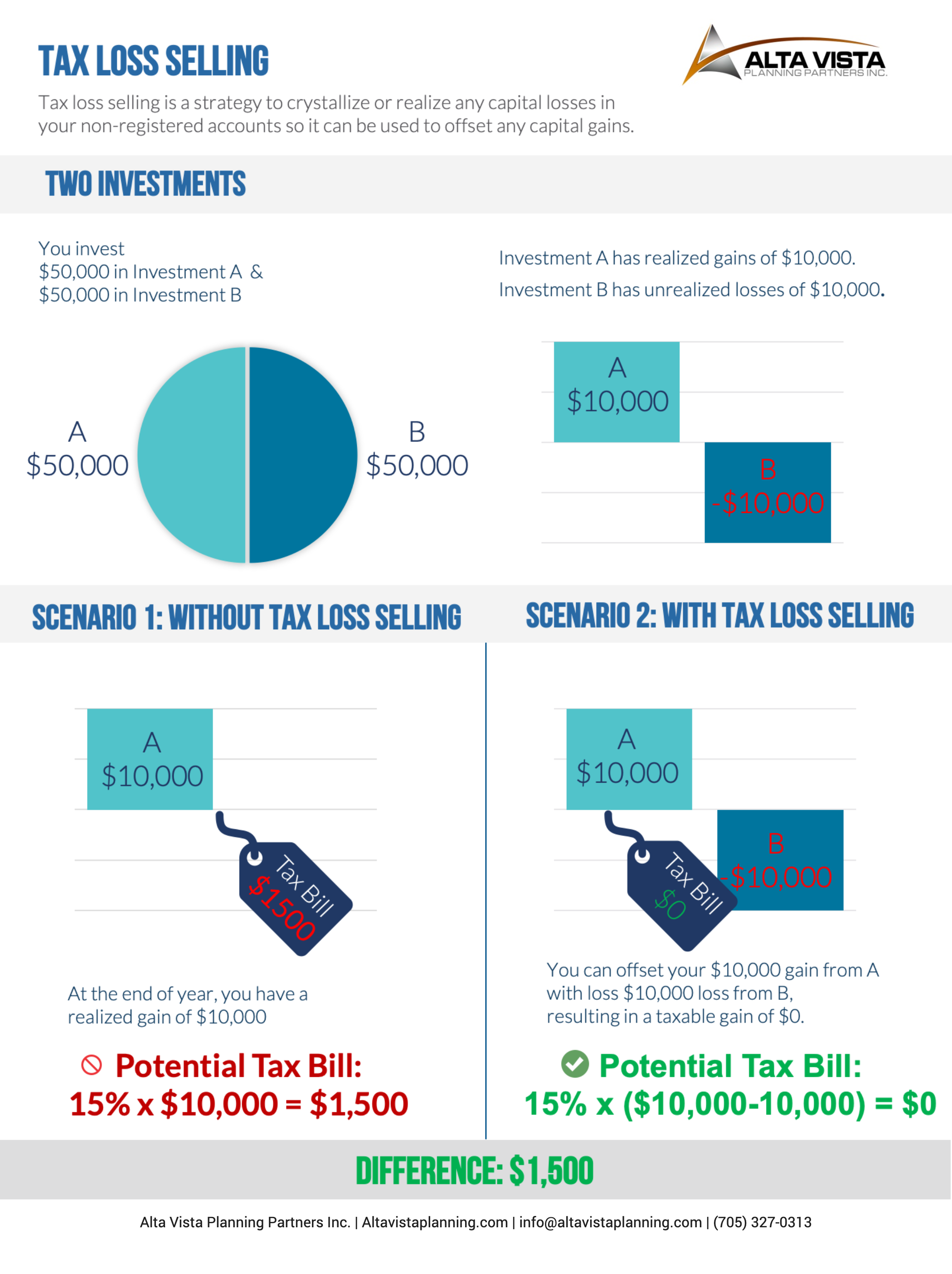

Tax Loss Selling

/in 2020 Only, Blog, Coronavirus, Investment, tax/by Financial Tech Tools

Over the last few weeks, the financial market has taken a downturn amidst fears over Coronavirus.

Understandably, you are concerned with your portfolio, it’s important to stay level-headed to avoid making financial missteps. However, staying level-headed doesn’t necessarily mean you sit there and do nothing. In fact, one consideration you can look is taking an active tax management approach.

Tax loss selling is a strategy to crystallize or realize any capital losses in your non-registered accounts so it can be used to offset any capital gains. There is no benefit to selling in your tax free savings account (TFSA) or registered retirement savings plan (RRSP).

You can apply capital losses back 3 years or carry them forward indefinitely, therefore we’ve outlined several situations that make sense for tax loss selling.

To better understand how tax-loss selling works, imagine a scenario in which someone invests $100,000, putting $50,000 in “Investment A” and $50,000 in “Investment B.”

At the end of one year, Investment A has risen by $10,000 and is now worth $60,000. Investment B has declined by $10,000 and is now worth $40,000.

Without tax-loss selling, the investor has a realized gain of $10,000 from Investment A, and has a potential tax bill of $1,500 (assuming he or she sells the shares and pays the 15% capital gains tax on the profit).

On the other hand, with tax-loss selling, selling Investment B to offset gains from Investment A. At the end of the year, instead of paying a $1,500 tax, the investor only has a potential tax bill of $0, for a potential tax savings of $1,500.

With the investor’s tax liability reduced by $1,500, that savings becomes money that can be invested back in the portfolio, used to maximize RRSP contributions, pay off debt, or spend as one pleases.

What Situations make sense for tax loss selling?

-

If you have an investment with a considerable capital gain, review through your current investments to see if there are any investments to sell at a loss.

-

Receiving a tax refund for a previous year. Keep in mind, you can apply capital losses back 3 years, therefore if you sold a property within the last 3 years for a considerable gain and paid the tax. This year, you could sell other investments at a loss and apply them back and get some tax paid back.

-

For tax deferral, with tax losses you can apply these losses back 3 years or carry them forward indefinitely, therefore you may want to trigger a loss today because if you are planning to sell that property in the next year or so, it may rebound and therefore you will lose the chance to offset the gains.

-

Lastly, you may have an investment in your portfolio that’s a dud. It might be time to move on and put your money into a different investment so that you can apply the loss in the future.

Tax Loss Selling is Complicated

There are specific conditions required by CRA that must be met in order for this strategy to work such as making sure your loss is not declared a “superficial loss” (these rules are very restrictive). A superficial loss is when you sell and trigger a capital loss, you cannot deduct the loss if you or an affiliate purchase an identical security within 30 days before or after your settlement date.

Another condition is that the sale of assets is prior to the year-end deadline (this varies by calendar year). You also need to make sure you have accurate information on the adjusted cost base (ACB) of your investment. When you file your taxes, any losses must be first used to offset capital gains in the current tax year, then any remaining losses can be carried back.

Before engaging in tax loss selling, you should contact us directly so we can make the strategy works for you.

Covid 19 Information for Plan Members

/in 2020 Only, Blog, Coronavirus, Investment/by Financial Tech Tools

The Coronavirus disease has created challenges across Canada and the world. It’s important to stay informed and educated so you’re equipped to take care of yourself, your family and your business.

We are ready to serve you and answer any questions you have about your employee benefits, insurance and investment. Please feel free to contact us if you have any questions. We are here for you.

For Employees:

Group Benefits Plans: Information about your group benefits plans, you can contact us directly as we work with multiple insurance companies to provide you with the benefits or your insurance benefits provider.

Travel Coverage under your Group Benefits Plan: Effective March 13, there is an official global travel advisory to avoid all non-essential travel outside of Canada until further notice. Since the Canadian government’s official global travel advisory travelling to a destination outside of Canada can impact your travel insurance coverage. We recommend you contact your emergency medical travel provider or contact us directly and we can help.

Short-term Disability Claims: In light of the current situation, the Canadian Life and Health Insurance Association (CLHIA) has created and distributed a Plan Member Confirmation of Illness Form that’s been created specifically for use when submitting a Short-term Disability (STD) claim if the absence is due to COVID-19 disease. The CLHIA has communicated with all insurers in Canada to make them aware of the custom form. All insurers will accept this form to initiate an STD claim.

If you’re submitting a STD claim because of COVID-19 disease, complete the form according to the instructions provided on the document and submit it to your insurer. If you’re not sure who the insurer of your disability benefits is, contact us. You can also use claim forms provided by the insurer, but we recommend using the CLHIA form as it’s specifically designed for the diagnosis of COVID-19. (The CLHIA is a not-for-profit, membership-based organization that represents 99% of Canada’s life and health insurance companies.)

Employee Assistance Program: If your group benefits plan includes an employee assistance program (EAP), you can access the service directly, the contact information is in your plan member booklet. If you’re not able to find this information, please contact us. An EAP can help you deal with difficult situations.

Federal Government Resources:

Covid 19 Information Centre

/in 2020 Only, Blog, Coronavirus, Investment/by Financial Tech Tools

The Coronavirus disease has created challenges across Canada and the world. It’s important to stay informed and educated so you’re equipped to take care of yourself, your family and your business.

We are ready to serve you and answer any questions you have about your employee benefits, insurance and investment. Please feel free to contact us if you have any questions. We are here for you.

Covid 19 Information for Plan Administrators

/in 2020 Only, Blog, Coronavirus, Investment/by Financial Tech Tools

The Coronavirus disease has created challenges across Canada and the world. It’s important to stay informed and educated so you’re equipped to take care of yourself, your family and your business.

We are ready to serve you and answer any questions you have about your employee benefits, insurance and investment. Please feel free to contact us if you have any questions. We are here for you.

Preparing your business in an emergency situation: If you have not prepared a business continuity plan, now is a good time to put one in place. The plan should outline the processes to minimize the impact on your business during an emergency situation.

Protect your employees: Be prepared, depending on your business, your employees might feel at risk to exposure to the Coronavirus. Make sure your employees are educated on prevention and symptoms. Please also make sure you are aware of your responsibilities as an employer. Resources are available on Employment and Social Development site.

Travel Coverage under your Group Benefits Plan: Effective March 13, there is an official global travel advisory to avoid all non-essential travel outside of Canada until further notice. Since the Canadian government’s official global travel advisory travelling to a destination outside of Canada can impact your travel insurance coverage. We recommend you contact your emergency medical travel provider or contact us directly and we can help.

Short-term Disability Claims: In light of the current situation, the Canadian Life and Health Insurance Association (CLHIA) has created and distributed a Plan Member Confirmation of Illness Form that’s been created specifically for use when submitting a Short-term Disability (STD) claim if the absence is due to COVID-19 disease. The CLHIA has communicated with all insurers in Canada to make them aware of the custom form. All insurers will accept this form to initiate an STD claim.

If you’re submitting a STD claim because of COVID-19 disease, complete the form according to the instructions provided on the document and submit it to your insurer. If you’re not sure who the insurer of your disability benefits is, contact us. You can also use claim forms provided by the insurer, but we recommend using the CLHIA form as it’s specifically designed for the diagnosis of COVID-19. (The CLHIA is a not-for-profit, membership-based organization that represents 99% of Canada’s life and health insurance companies.)

Employee Assistance Program: If your group benefits plan includes an employee assistance program (EAP), you can access the service directly, the contact information is in your plan member booklet. If you’re not able to find this information, please contact us. An EAP can help your employees deal with difficult situations.

Federal Government Resources:

Insurance Carriers and Benefit Providers

-

Assumption Life: 1-800-455-7337

-

Canada Life: 1-800-957-9777

-

Cooperators: 1-800-387-1963

-

Desjardins: 1-800-463-7843

-

Empire Life: 1-800-267-0215

-

Equitable Life: 1-800-722-6615

-

Greenshield: 1-888-711-1119

-

Industrial Alliance: 1-877-422-6487

-

La Capitale: 1-800-463-4856

-

Manulife: 1-800-268-6195

-

RBC: 1-855-264-2174

-

SSQ: 418-651-2588 or 514-223-2500

-

Sunlife: 1-877-786-7227 or 1-866-377-5818

Do I Qualify for the Canada Emergency Response Benefit & EI?

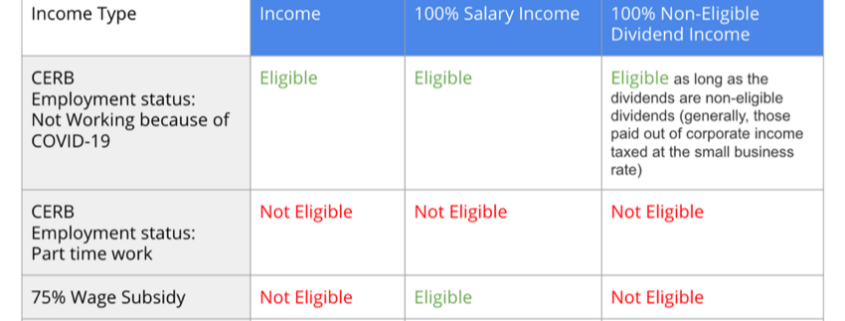

/in 2020 Only, Blog, Coronavirus/by Financial Tech ToolsTo help Canadians through this difficult time, the Federal Government created the Canada Emergency Response Benefit (CERB) and made changes to the Employment Insurance Program (EI). For those whose employment has affected by the Coronavirus, we have created a chart to help you figure out which program you qualify for and provide links to apply for each program.

The Federal Government has already made numerous changes to these programs so we will be updating this document whenever a change to the program is made.

Stay home and stay safe.

Help for Small/Medium Businesses & Entrepreneurs – 75% wage subsidy, $40,000 interest-free loan & more

/in 2020 Only, Blog, Business Owners, Coronavirus/by Financial Tech ToolsMarch 27, 2019 – Prime Minister Justin Trudeau announced programs and measures focused on helping Small & Medium Sized Businesses and Entrepreneurs cope with the economic consequences caused by the COVID-19 pandemic.

“With these new measures, our hope is that employers being pushed to laying off people due to COVID-19 will think again,” Trudeau said. “And for those of you who have already had to lay off workers, we hope you will re-hire them.”

Wage Subsidy increased to 75%

The Prime Minister has been under pressure from the small business community to boost the wage subsidy beyond the 10% initially announced to help keep people employed. Today, Mr. Trudeau announced the government will increase the wage subsidy from 10% to 75% to help keep employees on the payroll. This increase will be backdated to Sunday, March 15th.

“It is clear we have to do more, much more so we are bringing that percentage up to 75 per cent for qualifying businesses”

– Prime Minister Justin Trudeau

Canada Emergency Business Account (CEBA)

The CEBA will allow banks to offer $40,000 loans that will be interest-free for the 1st year which will be guaranteed by the government. If you meet certain conditions, $10,000 of the loan can be forgivable.

“To help you bridge to better times, we are launching the Canada Emergency Business Account. With this new measure banks will soon offer $40,000 which will be guaranteed by the government”

Defer GST, HST, Duty

The government will defer GST & HST payments, as well as duty and taxes owed on imports until June 2020.

“This is the equivalent of giving $30-billion of interest free loans to businesses”

Bank of Canada Rate Cut

Bank of Canada slashed its key overnight interest rate to 0.25%.

Full details and qualification requirements will be available on Monday.

Canada Emergency Response Benefit to help workers and businesses

/in 2020 Only, Blog, Coronavirus/by Financial Tech Tools$2,000/month for 4 months – Canada Emergency Response Benefit to help workers and businesses

To support workers and help businesses keep their employees, the government has proposed legislation to establish the Canada Emergency Response Benefit (CERB). This taxable benefit would provide $2,000 a month for up to four months for workers who lose their income as a result of the COVID-19 pandemic. The CERB would be a simpler and more accessible combination of the previously announced Emergency Care Benefit and Emergency Support Benefit.

The CERB would cover Canadians who have lost their job, are sick, quarantined, or taking care of someone who is sick with COVID-19, as well as working parents who must stay home without pay to care for children who are sick or at home because of school and daycare closures. The CERB would apply to wage earners, as well as contract workers and self-employed individuals who would not otherwise be eligible for Employment Insurance (EI).

Additionally, workers who are still employed, but are not receiving income because of disruptions to their work situation due to COVID-19, would also qualify for the CERB. This would help businesses keep their employees as they navigate these difficult times, while ensuring they preserve the ability to quickly resume operations as soon as it becomes possible.

The EI system was not designed to process the unprecedented high volume of applications received in the past week. Given this situation, all Canadians who have ceased working due to COVID-19, whether they are EI-eligible or not, would be able to receive the CERB to ensure they have timely access to the income support they need.

Canadians who are already receiving EI regular and sickness benefits as of today would continue to receive their benefits and should not apply to the CERB. If their EI benefits end before October 3, 2020, they could apply for the CERB once their EI benefits cease, if they are unable to return to work due to COVID-19. Canadians who have already applied for EI and whose application has not yet been processed would not need to reapply. Canadians who are eligible for EI regular and sickness benefits would still be able to access their normal EI benefits, if still unemployed, after the 16-week period covered by the CERB.

The portal for accessing the CERB would be available in early April.

Canadians would begin to receive their CERB payments within 10 days of application. The CERB would be paid every four weeks and be available from March 15, 2020 until October 3, 2020.

Get in Touch

Alta Vista Planning Partners Inc.

Tel: 705-327-0313

Email: info@altavistaplanning.com

359 West St. N 2nd Floor

Orillia, ON

L3V 5E5

Latest News

About

Our firm works with business owners and professionals to help them take excellent care of their families and their employees. If you own a small business or professional corporation, let's have a conversation. What matters most to you is what matters most to us!