How to Choose and Customize a Group Benefits Plan for Small Businesses

Building a Bright and Sustainable Future Together

As a small business owner, you recognize the significance of looking after your team and fostering a nurturing work environment. One method to demonstrate this is by providing a robust group benefits plan. This not only reflects your dedication to your team’s well-being but also is instrumental in drawing and retaining the best talent. Dive into the realm of group benefits and discover how to select and tailor the ideal plan for your small enterprise.

Understanding the Basics of Group Benefits

Group benefits plans are crafted to offer a variety of health, financial, and wellness advantages to your team members. These packages can encompass health and dental insurance, life and disability insurance, retirement savings alternatives, and more. The main benefit of a group benefits plan is its ability to distribute the risk among your team, making coverage more cost-effective and reachable for all.

Step 1: Assess Your Business Needs

Before diving into a group benefits plan, it’s vital to evaluate the requirements of your business and your team. Ponder over these questions:

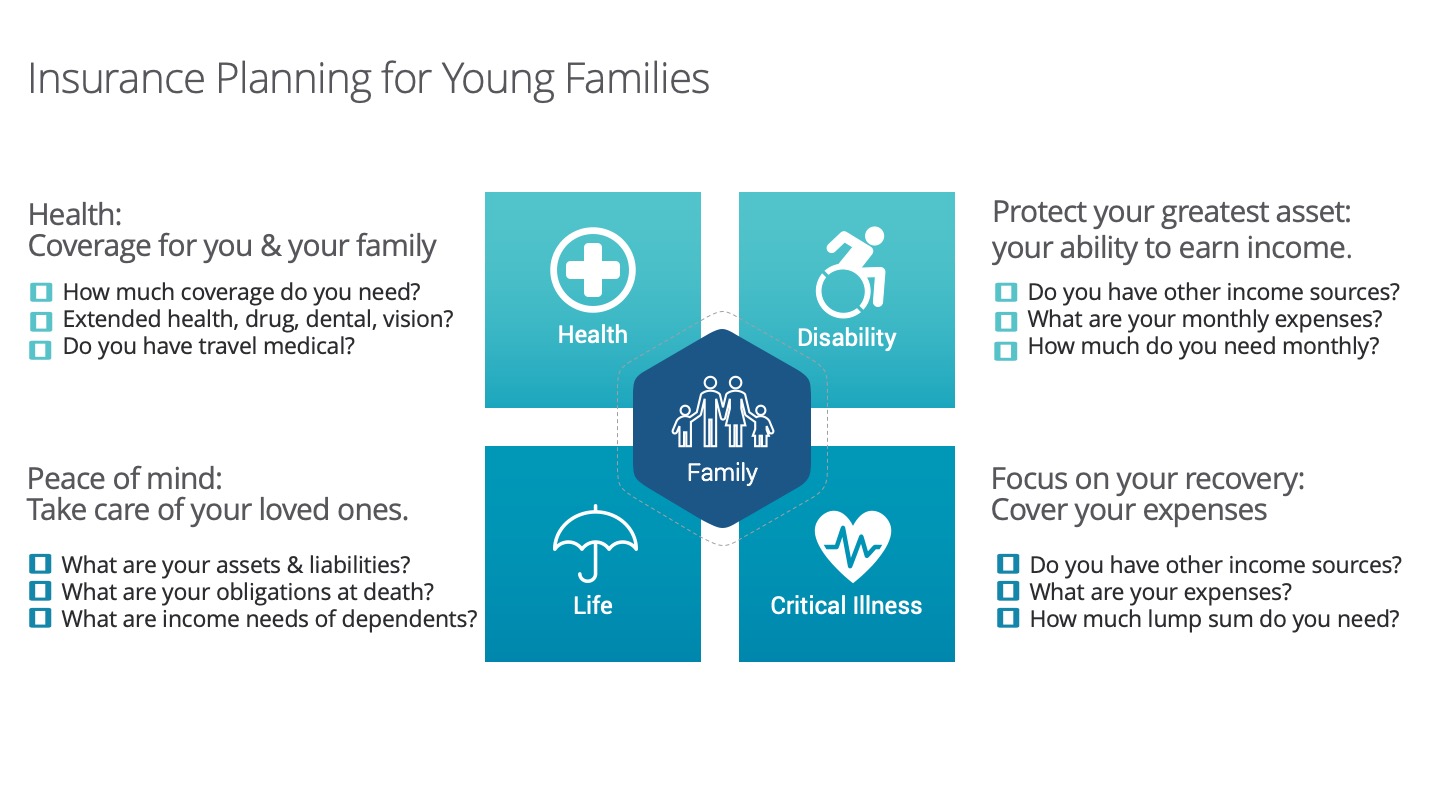

- What’s the profile of your workforce? Think about age, family composition, and health statuses.

- Which benefits are most cherished by your employees? Is it health insurance, dental care, or retirement savings?

- How much can you allocate for group benefits? Keep in mind, offering benefits is a commitment to your team’s welfare.

Step 2: Collaborate with a Benefits Specialist

Teaming up with a benefits specialist is akin to having a navigator on your quest to devise the perfect plan. They will assist you in traversing the intricate landscape of insurance choices, rules, and compliance mandates. They’ll engage closely with you to grasp the distinct needs of your business and craft a plan that matches your budget and principles.

Step 3: Customize Your Plan

Adaptability is paramount when shaping a benefits plan that appeals to your team. Here are some avenues for personalization:

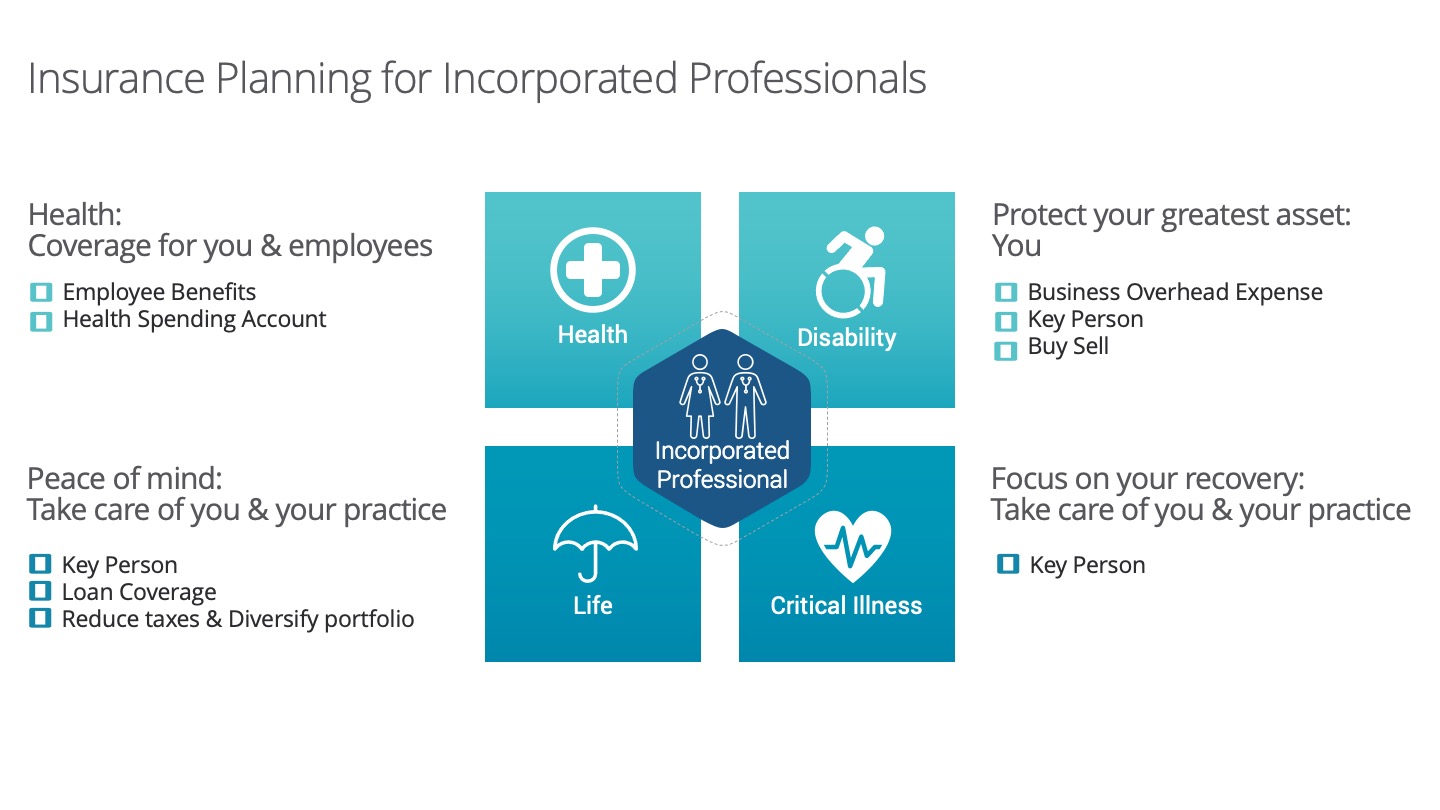

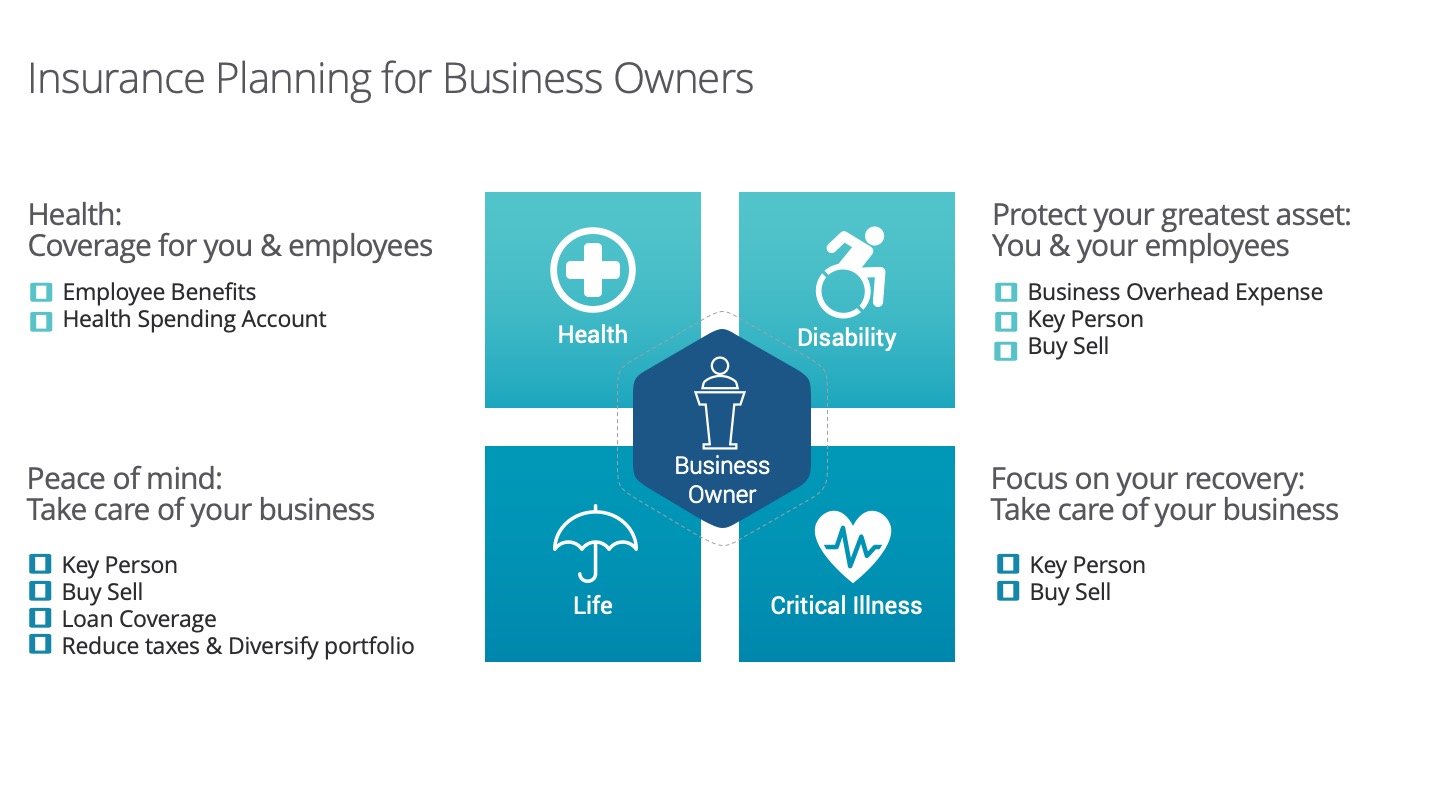

- Benefit Choices: Opt for a blend of health, dental, vision, life, and disability insurance based on what your team values.

- Wellness Initiatives: Mull over introducing wellness programs such as fitness center memberships, mental health resources, and stress alleviation workshops.

- Retirement Schemes: Offer retirement savings avenues like a Group RRSP or a staff pension scheme.

Step 4: Educate Your Employees

The efficacy of a group benefits plan hinges on transparent communication and enlightenment. Ensure your team comprehends the worth of the benefits provided and the methods to utilize them optimally. Arrange seminars, online sessions, or informational meetups to aid them in making knowledgeable choices about their coverage.

Step 5: Regularly Review and Adjust

The dynamics of your business and the needs of your team will transform over time. Hence, it’s crucial to revisit your group benefits plan annually and make requisite modifications. This guarantees that your plan stays in sync with your objectives and consistently delivers value to your team.

Building a Sustainable Future Together

As you embark on the path of picking and personalizing a group benefits plan for your small enterprise, bear in mind that your collaboration with your team is central to the process. By placing their welfare at the forefront and presenting a comprehensive benefits package, you’re not merely paving a brighter path for your team but also cultivating a sustainable work setting that promotes allegiance, efficiency, and expansion.