Business Owners: 2020 Tax Planning Tips for the End of the Year

It’s a great time to review your business finances now that we are nearing year-end. Your business may be affected by recent tax changes or new measures to help with financial losses due to COVID-19. Figuring out the tax ramifications of these new measures can be complicated, so please don’t hesitate to consult your accountant and us to determine how this may affect your business finances.

We’re assuming that your corporate year-end is December 31. If it’s not, then this information will be useful when your business year-end comes up.

Below, we have listed some of the critical areas to consider and provide you with some helpful guidelines to make sure that you cover all the essentials. We have divided our tax planning tips into four sections:

-

Year-end tax checklist

-

Remuneration

-

Business tax

-

Estate

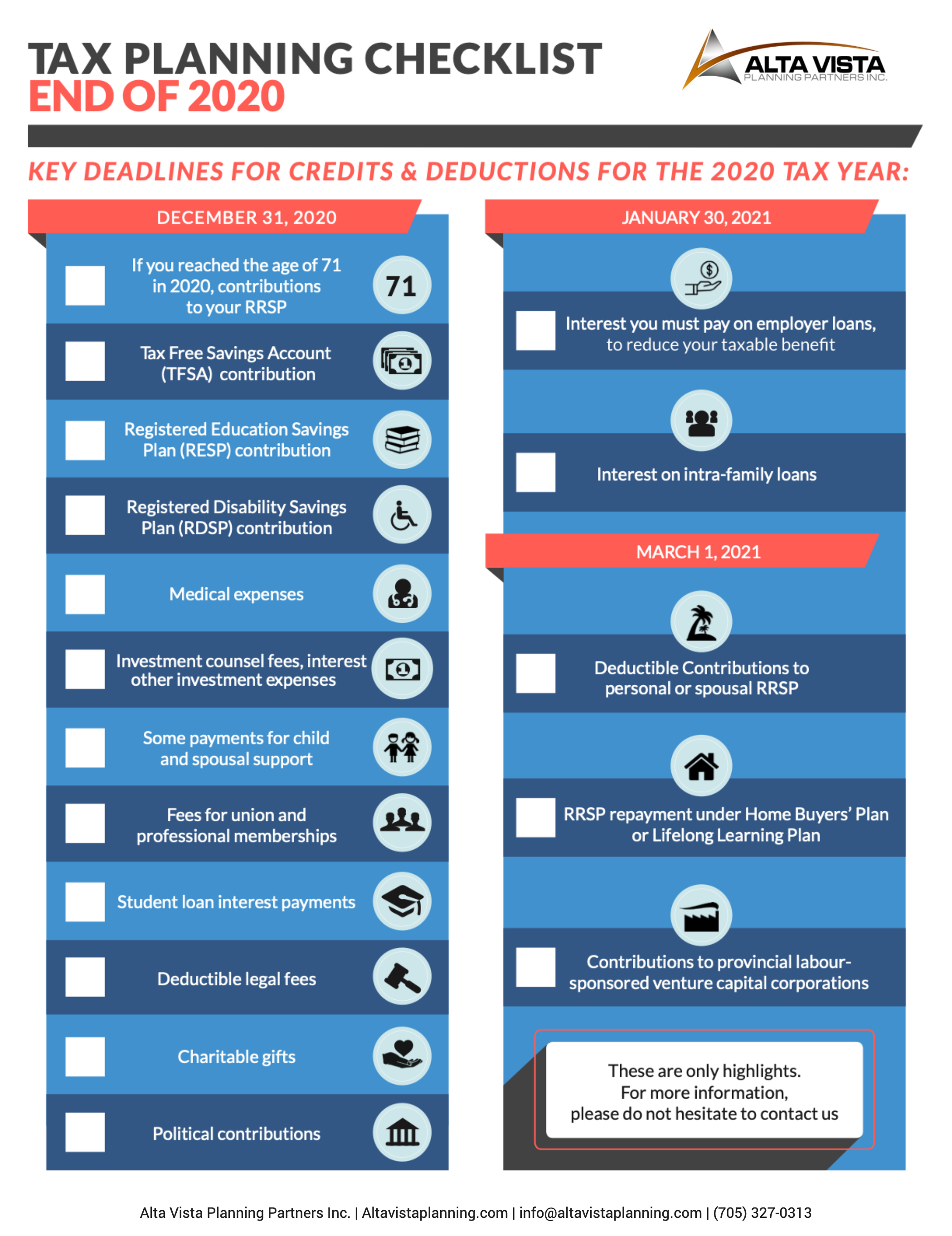

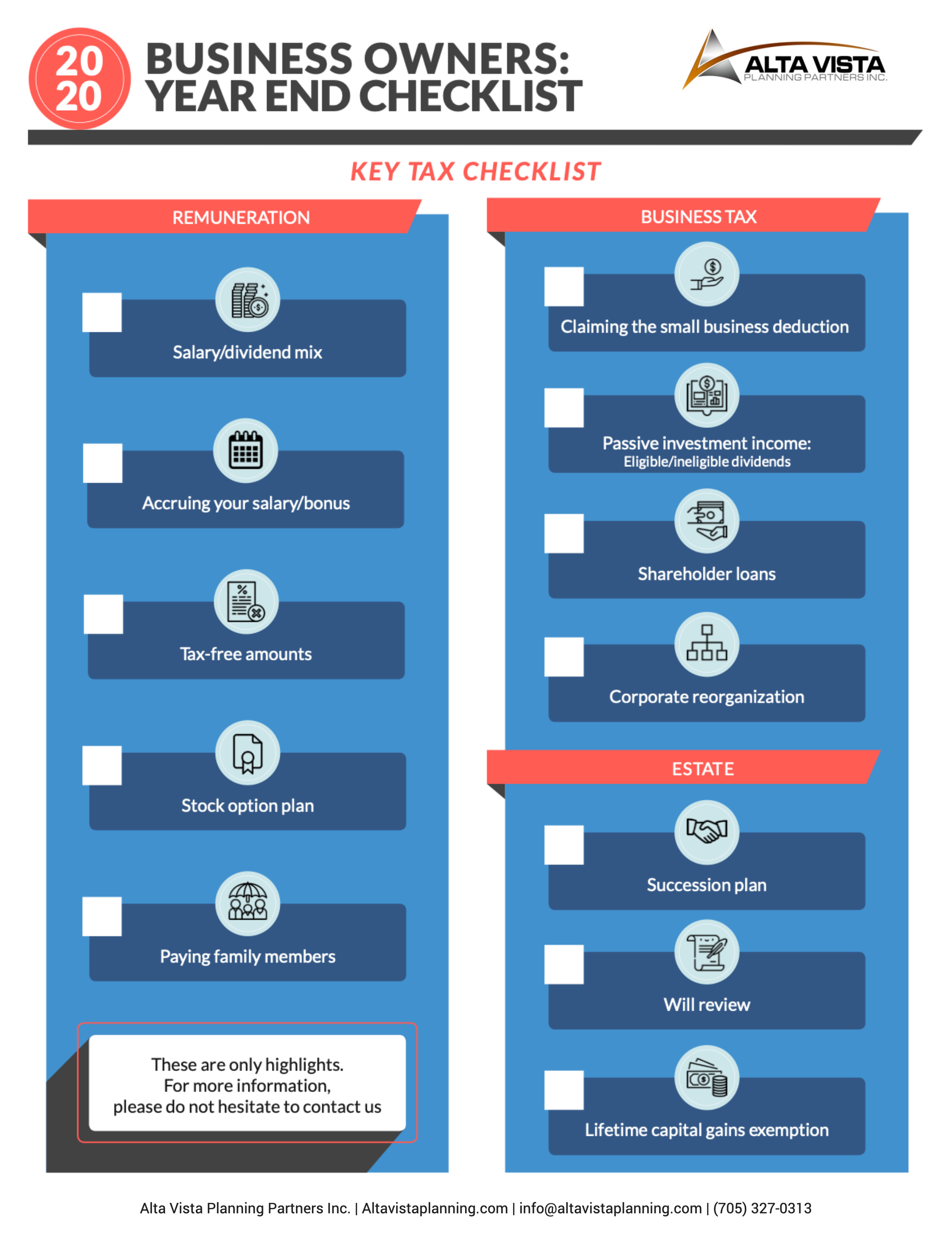

Business Year-End Tax Checklist

Remuneration

-

Salary/dividend mix

-

Accruing your salary/bonus

-

Stock option plan

-

Tax-free amounts

-

Paying family members

-

COVID-19 wage subsidy measures for employers

Business Tax

-

Claiming the small business deduction

-

Shareholder loans

-

Passive investment income including eligible and ineligible dividends

-

Corporate reorganization

Estate

-

Will review

-

Succession plan

-

Lifetime capital gains exemption

Remuneration

What is your salary and dividend mix?

Individuals who own incorporated businesses can elect to receive their income as either salary or as dividends. Your choice will depend on your situation. Consider the following factors:

-

Your current and future cash flow needs

-

Your personal income level

-

The corporation’s income level

-

Tax on income splitting (TOSI) rules. When TOSI rules apply, be aware that dividends are taxed at the highest marginal tax rate.

-

Passive investment income rules

Also consider the difference between salary and dividends:

Salary

-

Can be used for RRSP contribution

-

Reduces corporate tax bill

-

Subject to payroll tax

-

Subject to CPP contribution

-

Subject to EI contribution

Dividend

-

Does not provide RRSP contribution

-

Does not reduce a corporate tax bill

-

No tax withholdings

-

No CPP contribution

-

No EI Insurance contribution

-

Depending on the province¹, receive up to $50,000 of eligible dividends at a low tax rate provided you have no other sources of income

¹The amount and tax rate will vary based on province/territory you live in.

It’s worth considering ensuring that you receive a salary high enough to take full advantage of the maximum RRSP annual contribution that you can make. For 2020, salaries of $154,611 will provide the maximum RRSP room of $27,830 for 2021.

Is it worth accruing your salary or bonus this year?

You could consider accruing your salary or bonus in the current year but delaying payment of it until the following year. If your company’s year-end is December 31, your corporation will benefit from a deduction for the year 2020. The source deductions are not required to be remitted until actual salary or bonus payment in 2021.

Stock Option Plan

If your compensation includes stock options, check if you will be affected by the stock option rules that went into effect on January 1, 2020. These new rules cap the amount of specific employee stock options eligible for the stock option deduction at $200,000 as of January 1, 2020. These rules will not affect you if a Canadian controlled private corporation grants your stock options.

Tax-Free Amounts

If you own your corporation, pay yourself tax-free amounts if you can. Here are some ways to do so:

-

Pay yourself rent if the company occupies space in your home.

-

Pay yourself capital dividends if your company has a balance in its capital dividend account.

-

Return “paid-up capital” that you have invested in your company

Do you employ members of your family?

Employing and paying a salary to family members who work for your incorporated business is worth considering. You could receive a tax deduction against the salary you pay them, providing that the salary is “reasonable” with the work done. In 2020, the individual can earn up to $13,229 (increased for 2020 from $12,298) and pay no federal tax. This also provides the individual with RRSP contribution room, CPP and allows for child-care deductions. Bear in mind there are additional costs incurred when employing someone, such as payroll taxes and contributions to CPP.

COVID-19 wage subsidy measures for employers

To deal with the financial hardships introduced by COVID-19, the federal government introduced two wage subsidy measures:

-

The Canada Emergency Wage Subsidy (CEWS) program. With this, you can receive a subsidy of up to 85% of eligible remuneration that you paid between March 15 and December 19, 2020, if you had a decrease in revenue over this period. You must submit your application for the CEWS no later than January 31, 2021.

-

The Temporary Wage Subsidy (TWS) program. With this program, which reduces the amount of payroll deductions you needed to remit to the CRA, you can qualify for a subsidy equal to 10% of any remuneration that you paid between March 18, 2020, and June 19, 2020. You can claim up to a maximum of $1,375 per employee and $25,000 in total.

You can apply for both programs if you are eligible. If you qualify for the TWS but did not reduce your payroll remittances, you can still apply. The CRA will then either pay the subsidy amount to you or transfer it over to your next year’s remittance.

Business Tax

Claiming the Small Business Deduction

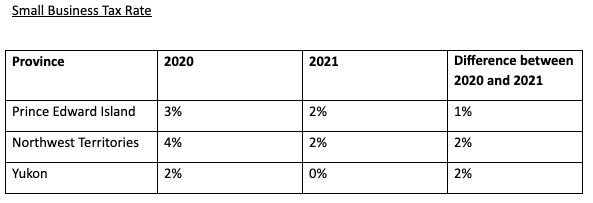

Are you able to claim a small business deduction? The federal small business tax rate decreased to 9% in 2019. It did not increase in 2020, nor is it expected to increase in 2021. From a provincial level, there will be changes in the following provinces:

Therefore, a small business deduction in 2020 is worth more than in 2021 for these provinces.

Should you repay any shareholder loans?

Borrowing funds from your corporation at a low or zero interest rate means that you are considered to have received a taxable benefit at the CRA’s 1% prescribed interest rate, less actual interest that you pay during the year or thirty days after the end of the year. You need to include the loan in your income tax return unless it is repaid within one year after the end of your corporation’s taxation year.

For example, if your company has a December 31 year-end and loaned you funds on November 1, 2020, you must repay the loan by December 31, 2021; otherwise, you will need to include the loan as taxable income on your 2020 personal tax return.

Passive investment income

If your corporation has a December year-end, then 2020 will be the second taxation year that the current passive investment income rules may apply to your company.

New measures were introduced in the 2018 federal budget relating to private businesses, which earn passive investment income in a corporation that also operates an active business.

There are two key parts to this:

-

Limiting access to dividend refunds. Essentially, a private company will be required to pay ineligible dividends to receive dividend refunds on some taxes. In the past, these could have been refunded when an eligible dividend was paid.

-

Limiting the small business deduction. This means that, for impacted companies, the small business deduction will be reduced at a rate of $5 for every $1 of investment income over $50,000. It is eliminated if investment income exceeds $150,000. Ontario and New Brunswick are not following these federal rules. Therefore, the provincial small business deduction is still available for income up to $500,000 annually.

Suppose your corporation earns both active business and passive investment income. In that case, you should contact your accountant and us directly to determine if there are any planning opportunities to minimize the new passive investment income rules’ impact. For example, you can consider a “buy and hold” strategy to help defer capital gains.

Think about when to pay dividends and dividend type

When choosing to pay dividends in 2020 or 2021, you should consider the following:

-

Difference between the yearly tax rate

-

Impact of tax on split income

-

Impact of passive investment income rules

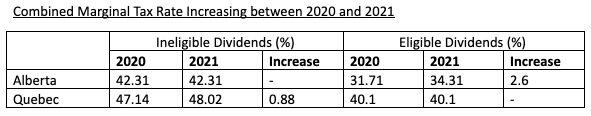

Except for two provinces, Quebec and Alberta, the combined top marginal tax rates will not change from 2020 to 2021 at a provincial level. Therefore, it will not make a difference for most locations if you choose to pay in 2020 or 2021.

In Quebec and Alberta, as there will be increases in the combined marginal tax rate, you will have potential tax savings available if you choose to pay dividends in 2020 rather than 2021.

When deciding to pay a dividend, you will need to decide whether to pay out eligible or ineligible dividends. Consider the following:

-

Dividend refund claim limits: Eligible refundable dividend tax on hand (ERDTOH) vs Ineligible Refundable dividend tax on hand (NRDTOH)

-

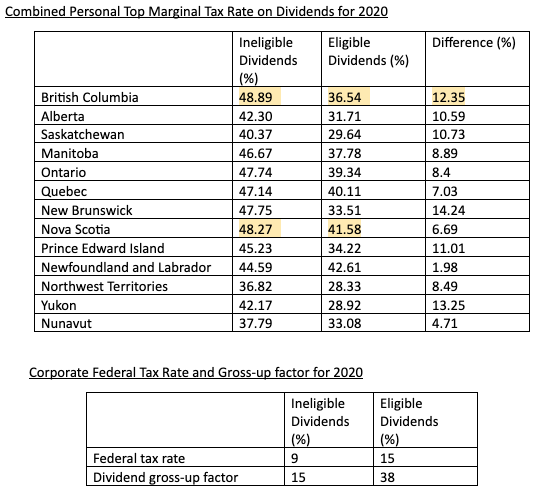

Personal marginal tax rate of eligible vs. ineligible dividends (see chart below)

Given the passive investment income rules, typically, it makes sense to pay eligible dividends to deplete the ERDTOH balance before paying ineligible dividends. (Please note that ineligible dividends can also trigger a refund from the ERDTOH account.)

Eligible dividends are taxed at a lower personal tax rate than ineligible dividends (based on top combined marginal tax rate). However, keep in mind that when ineligible dividends are paid out, they are subject to the small business deduction; therefore, the dividend gross-up is 15% while eligible dividends are subject to the general corporate tax rate, a dividend gross-up is 38%. It’s important to talk to a professional to determine what makes the most sense when selecting the type of dividend to pay out of your corporation.

Corporate Reorganization

It might be time to revisit your corporate structure, given recent changes to private corporation rules on income splitting and passive investment income to provide more control on dividend income distribution.

Before you issue dividends to other shareholders in your private company (this includes your spouse, children, or other relatives), review the TOSI rules’ impact with us or your tax and legal advisors.

Another reason to reassess your structure is to segregate investment assets from your operating company for asset protection. You don’t want to trigger TOSI, so make sure you structure this properly. If you are considering succession planning, this is the time to evaluate your corporate structure as well.

Another aspect of corporate reorganization can be loss consolidation – where you consolidate losses from within related corporate groups.

Estate

Ensure your will is up to date

If your estate plan includes an intention for your family members to inherit your business using a trust, ensure that this plan is still tax-effective; income tax changes from January 1, 2016 eliminated the taxation at graduated rates in testamentary trusts and now taxes these trusts at the top marginal personal income tax rate. Review your will to ensure that any private company shares that you intend to leave won’t be affected by the most recent TOSI rules.

Succession plan

Consider a succession plan to ensure your business is transferred to your children, key employees or outside party in a tax-efficient manner.

Lifetime Capital Gains Exemption

If you sell your qualified small business corporation shares, you can qualify for the lifetime capital gains exemption (In 2020, the exemption is $883,384), where the gain is entirely exempt from tax. The exemption is a cumulative lifetime exemption; therefore, you don’t have to claim the entire amount at once.

The issues we discussed above can be complicated. Contact your accountant and us if you have any questions. We can help.