2020 Financial Calendar

2020 Financial Calendar

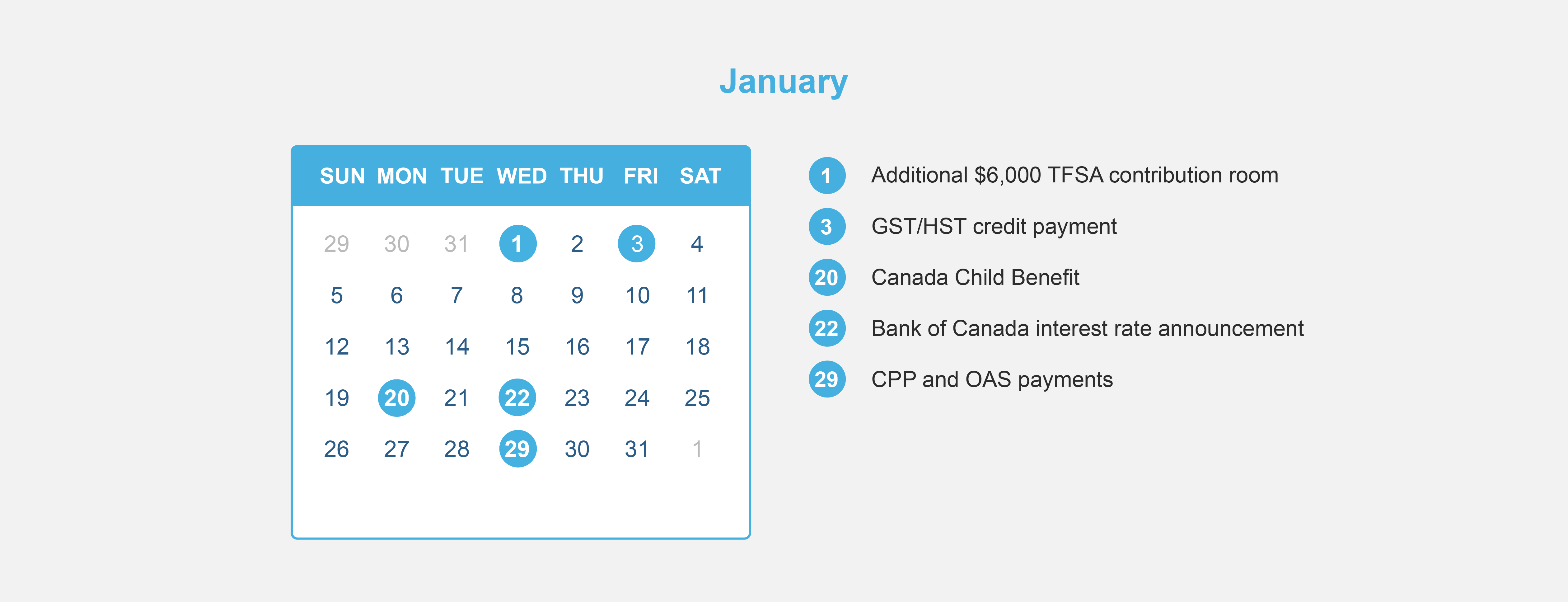

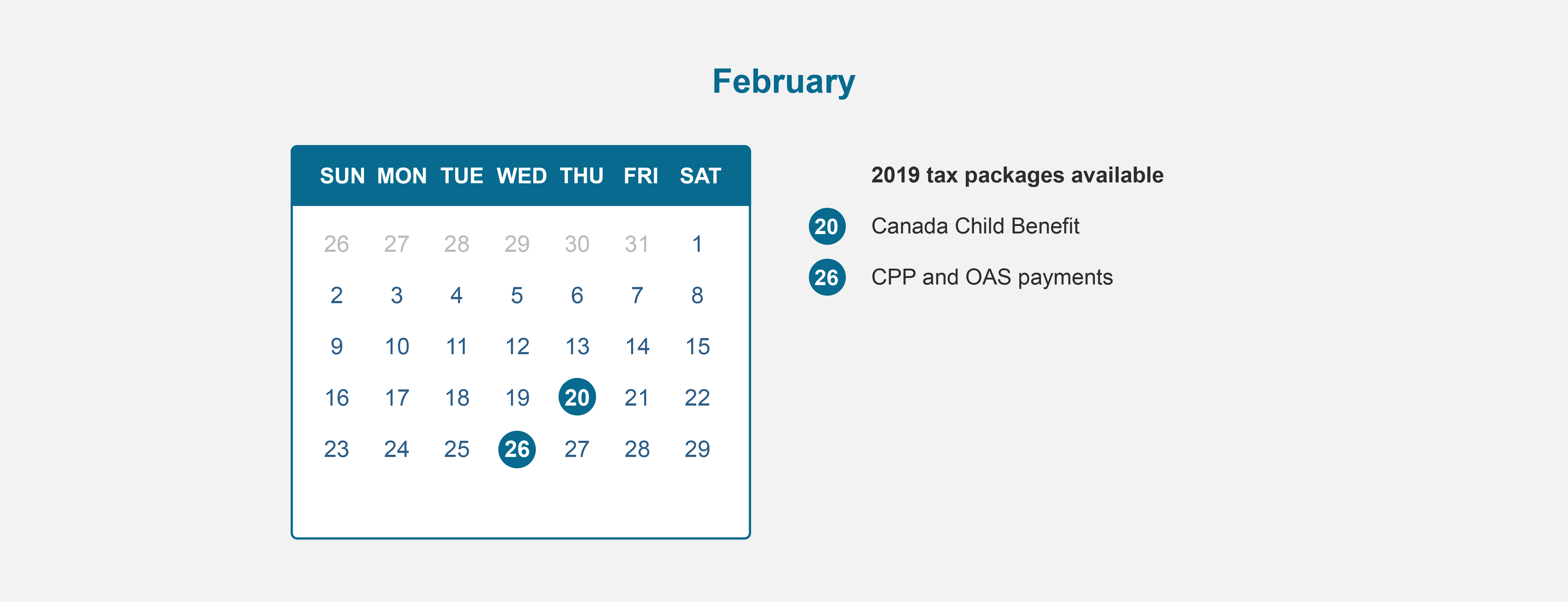

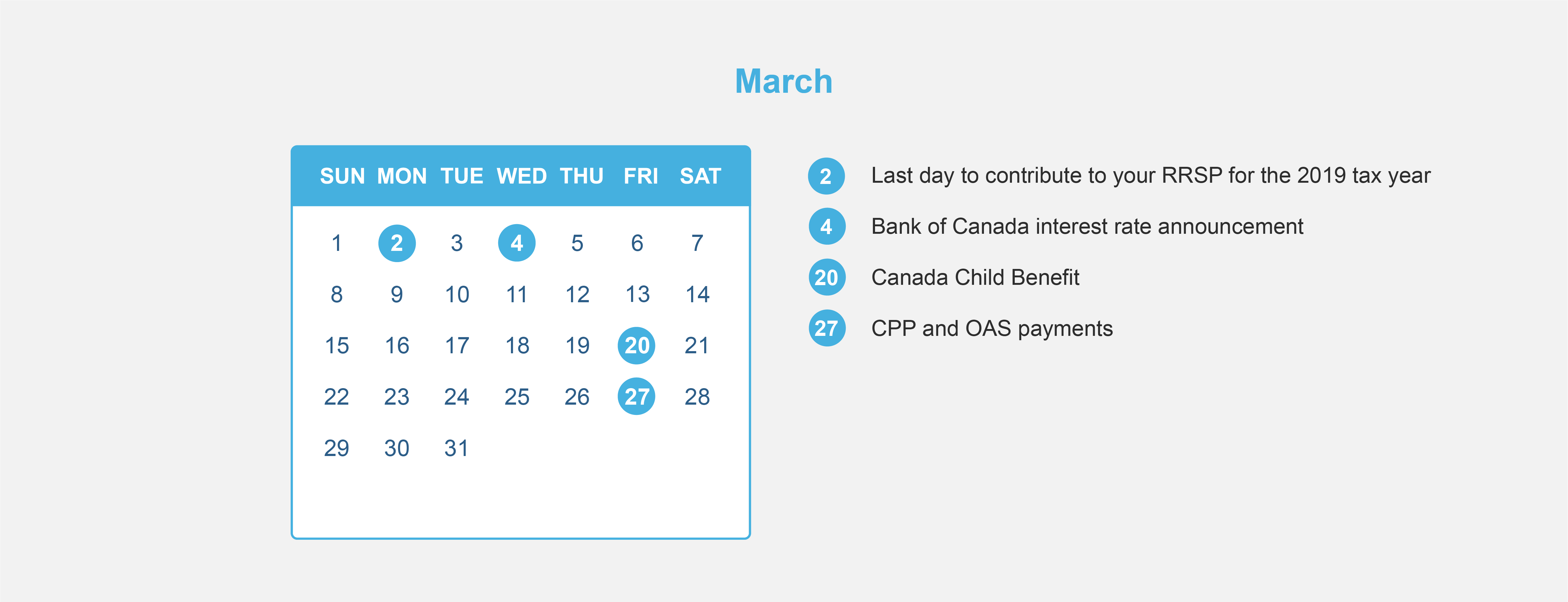

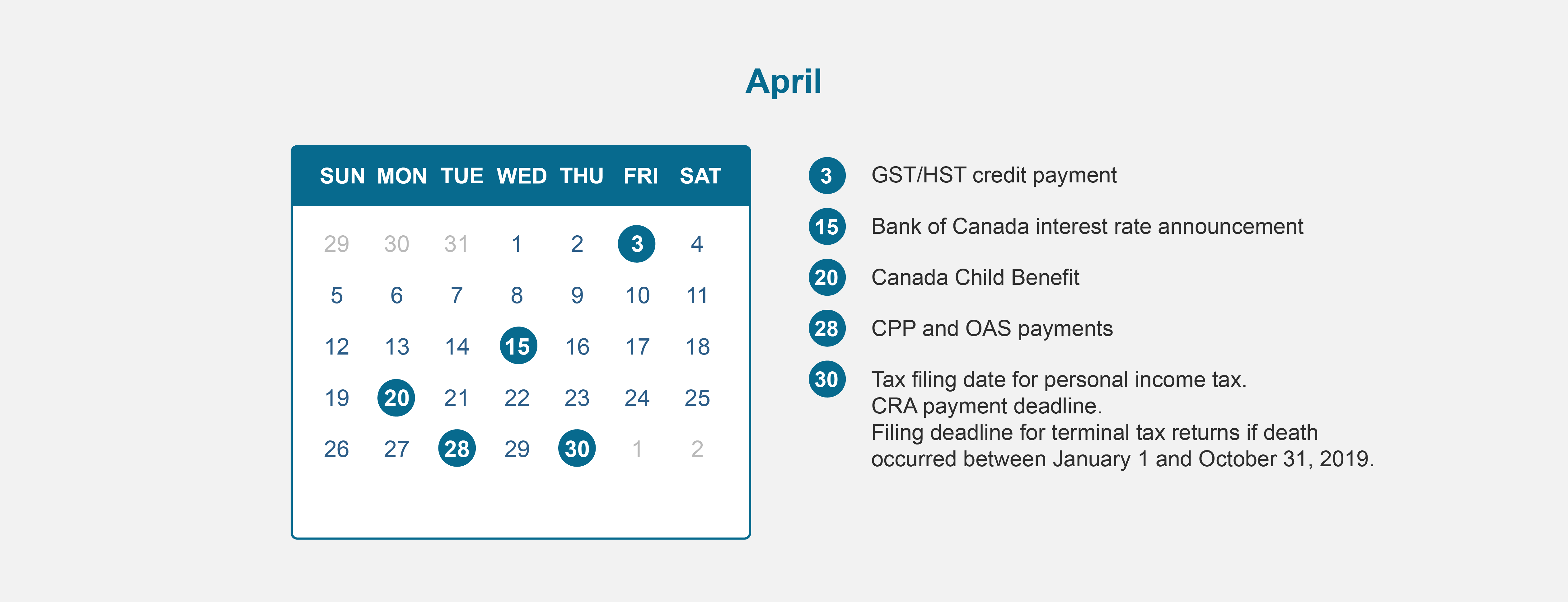

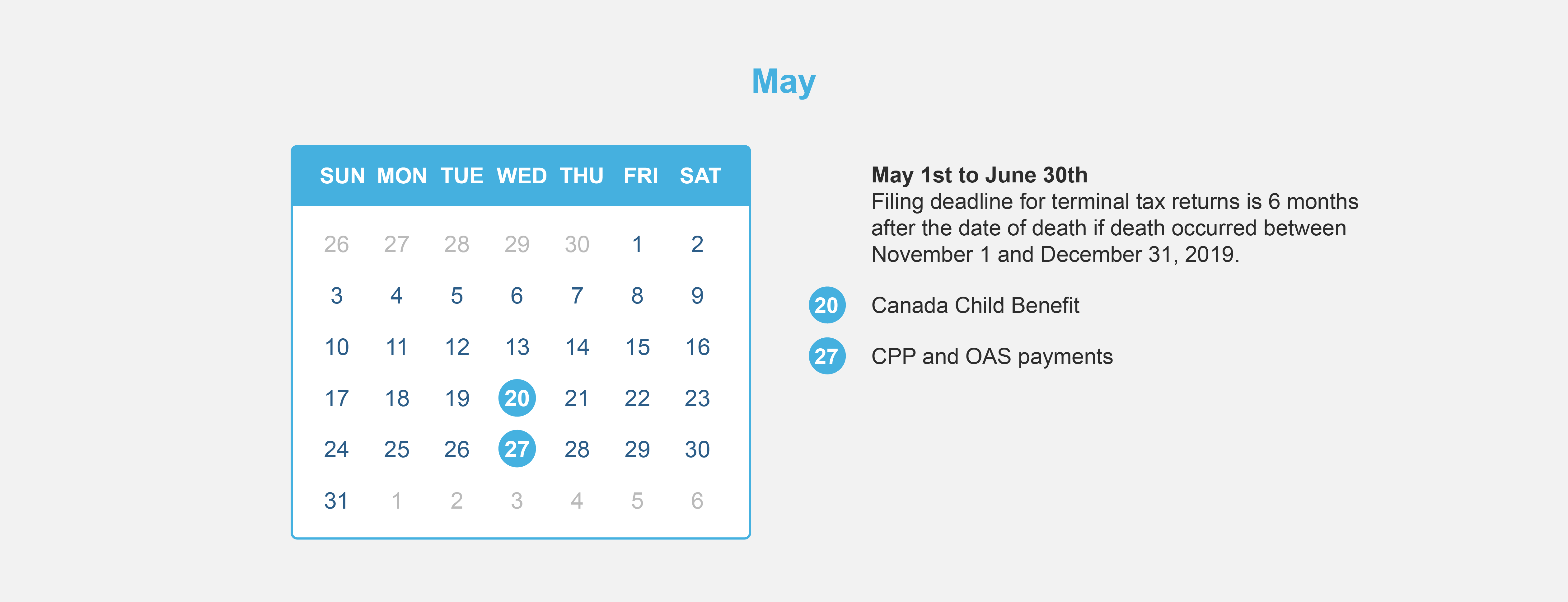

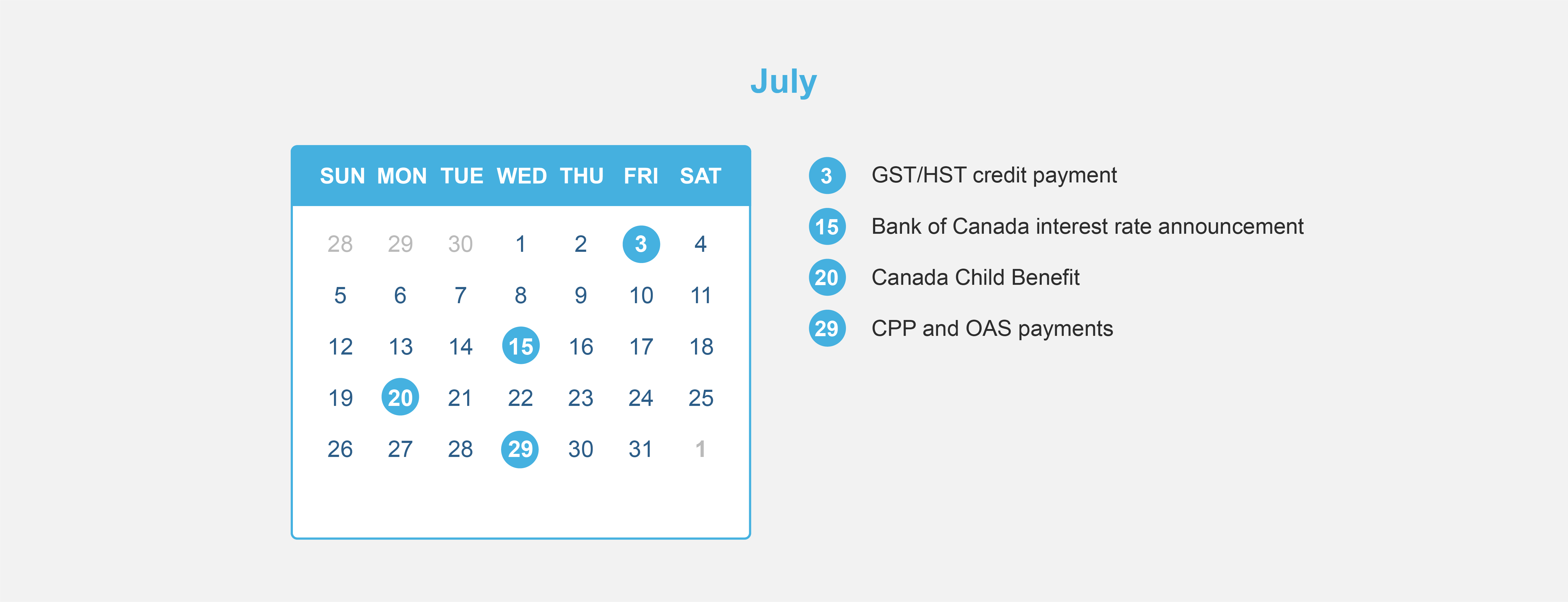

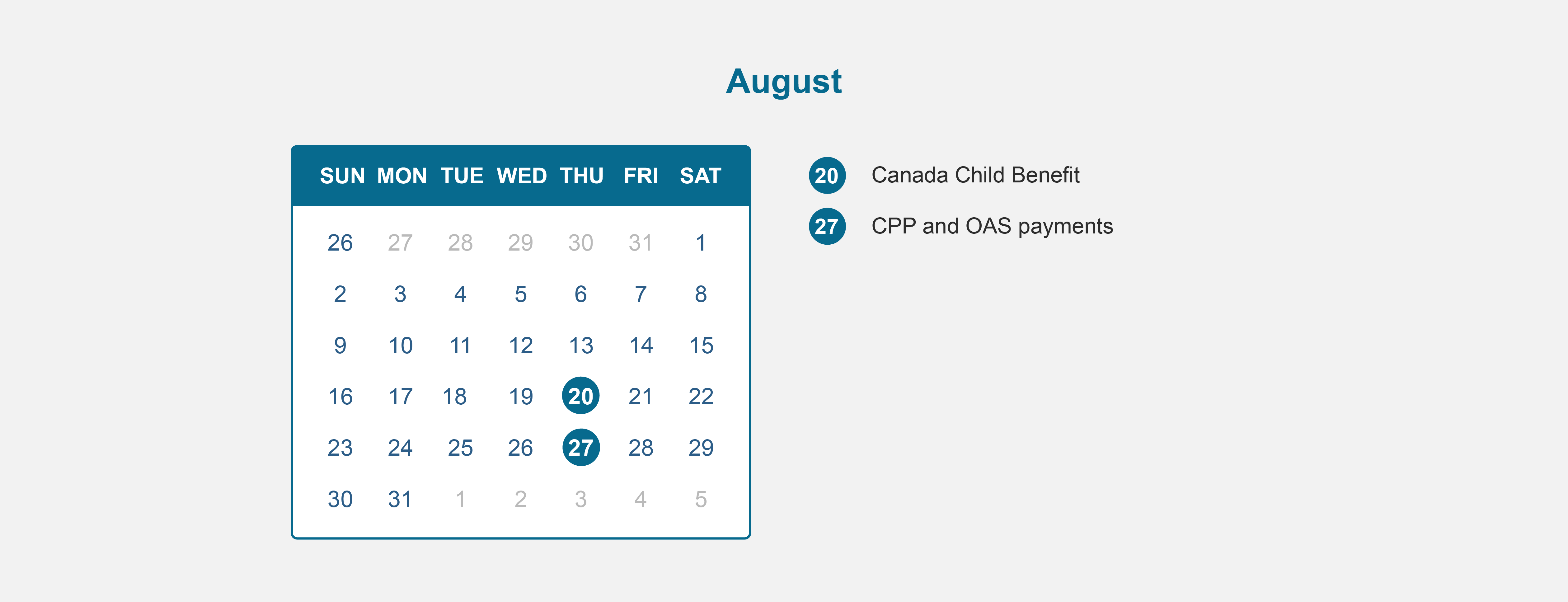

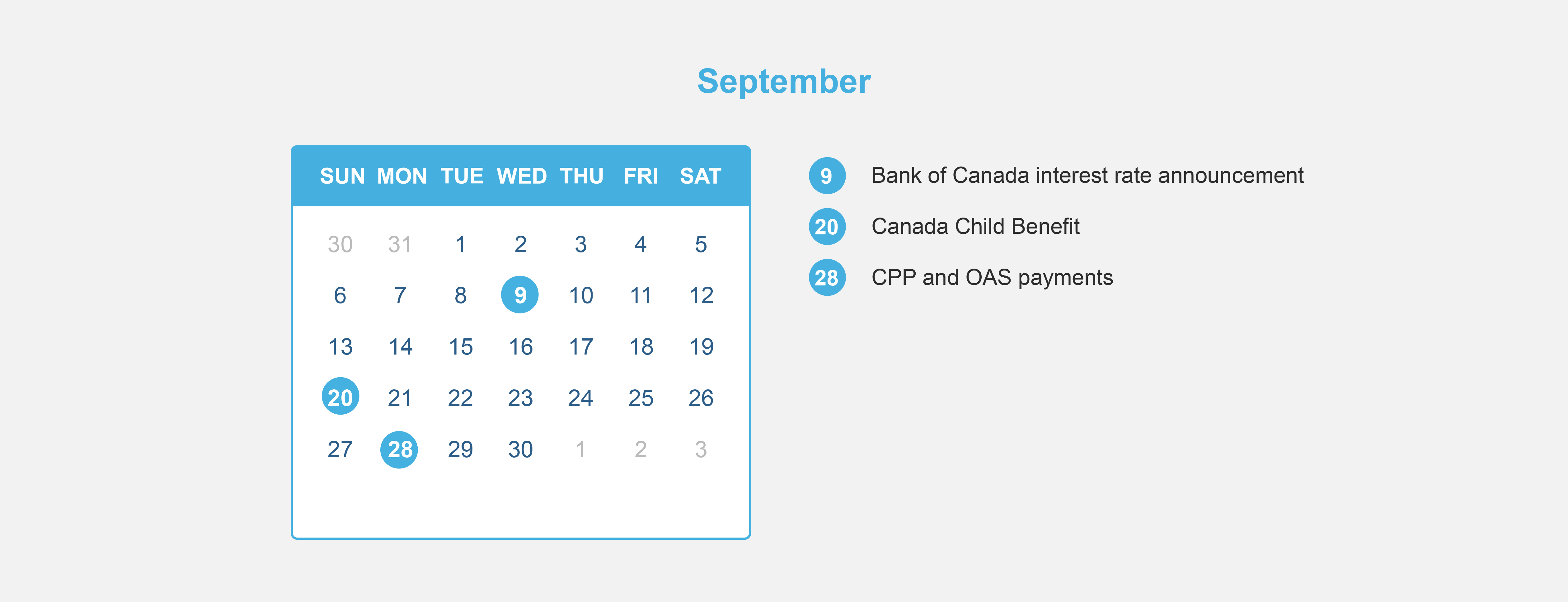

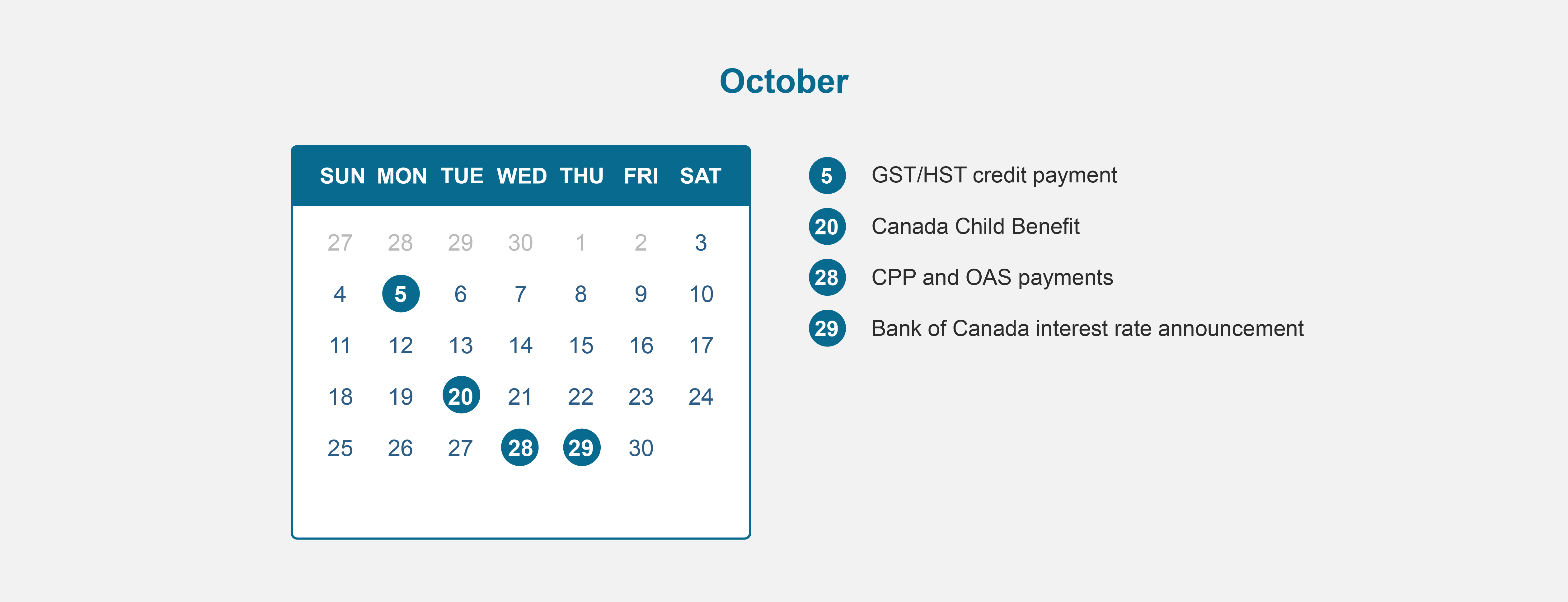

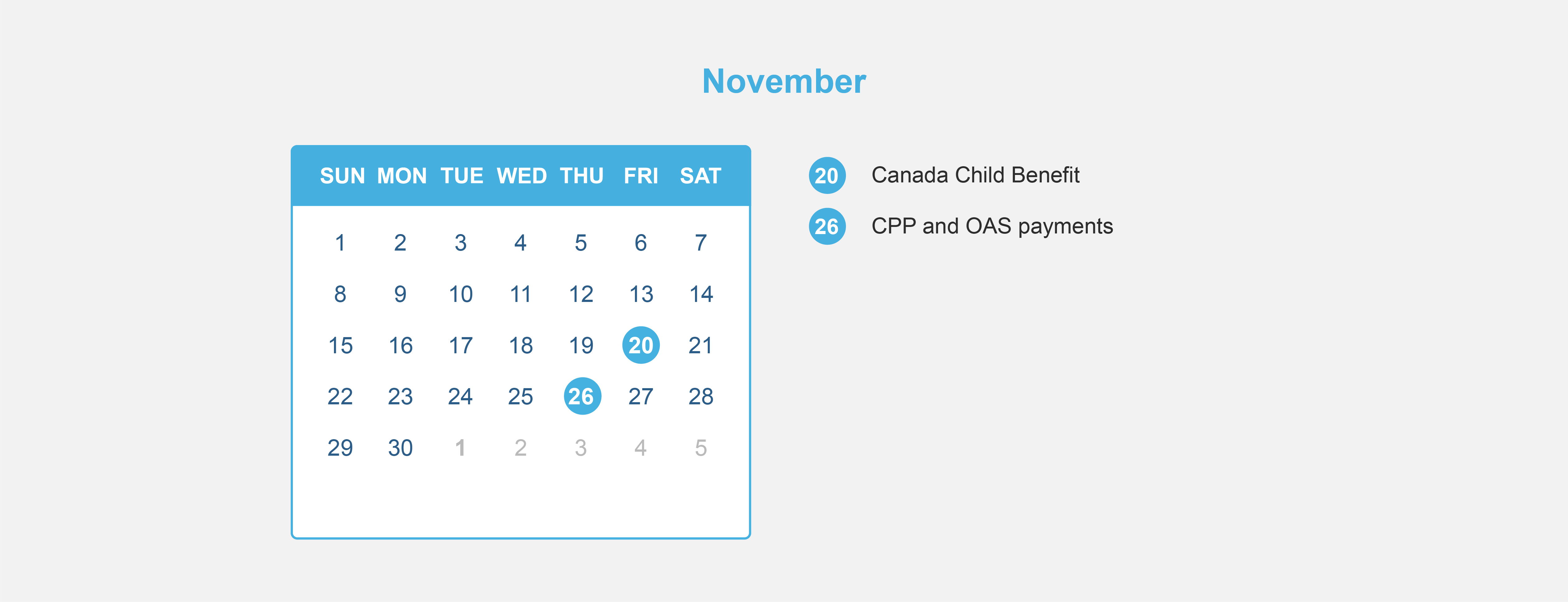

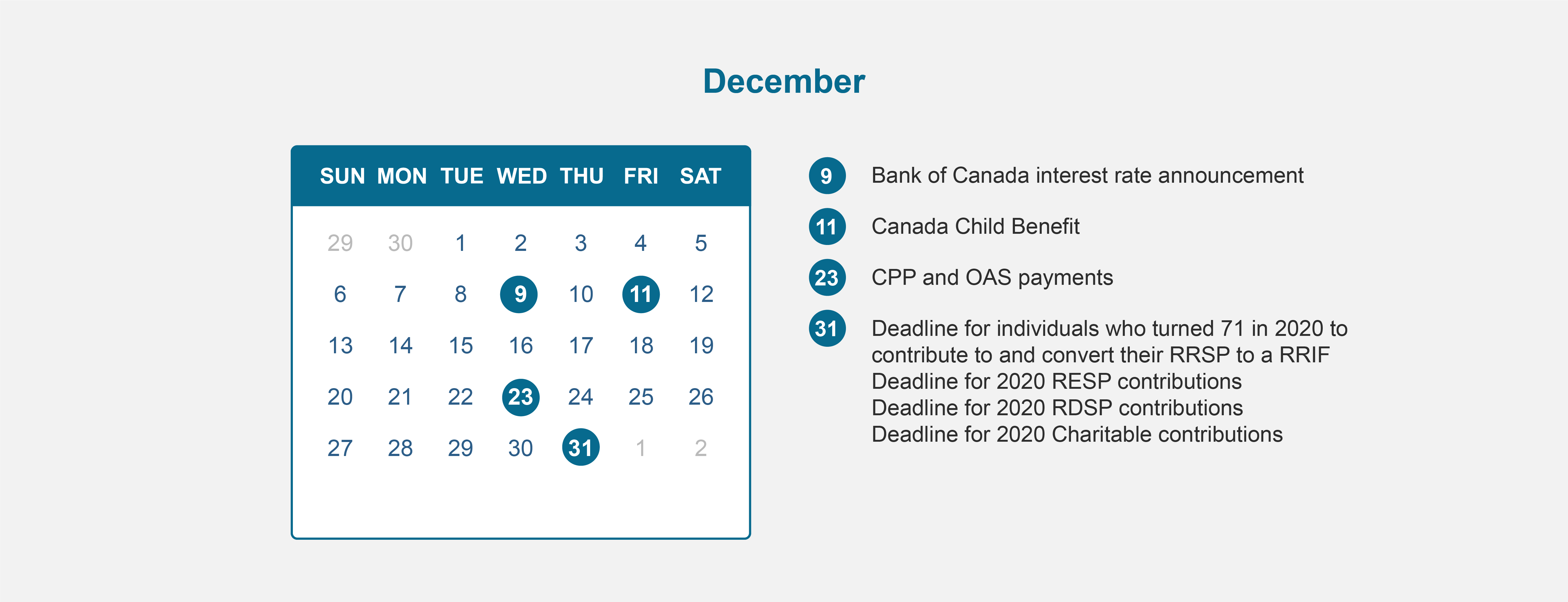

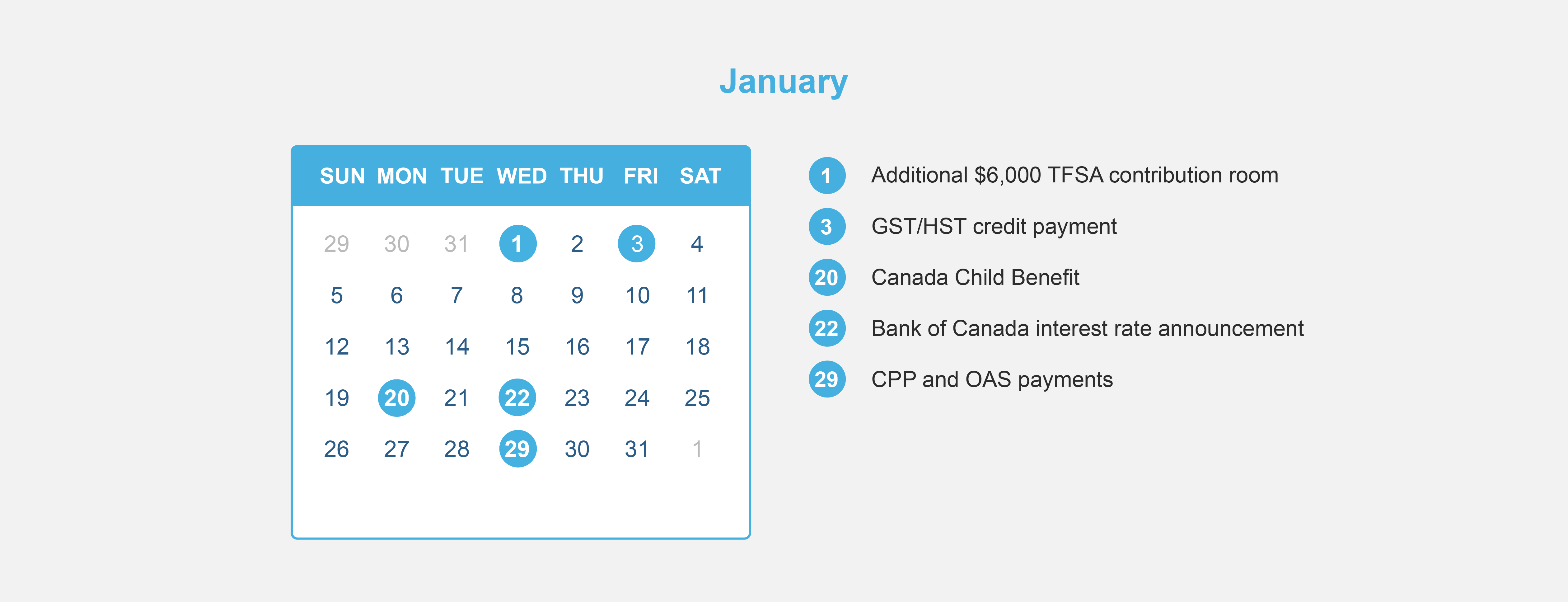

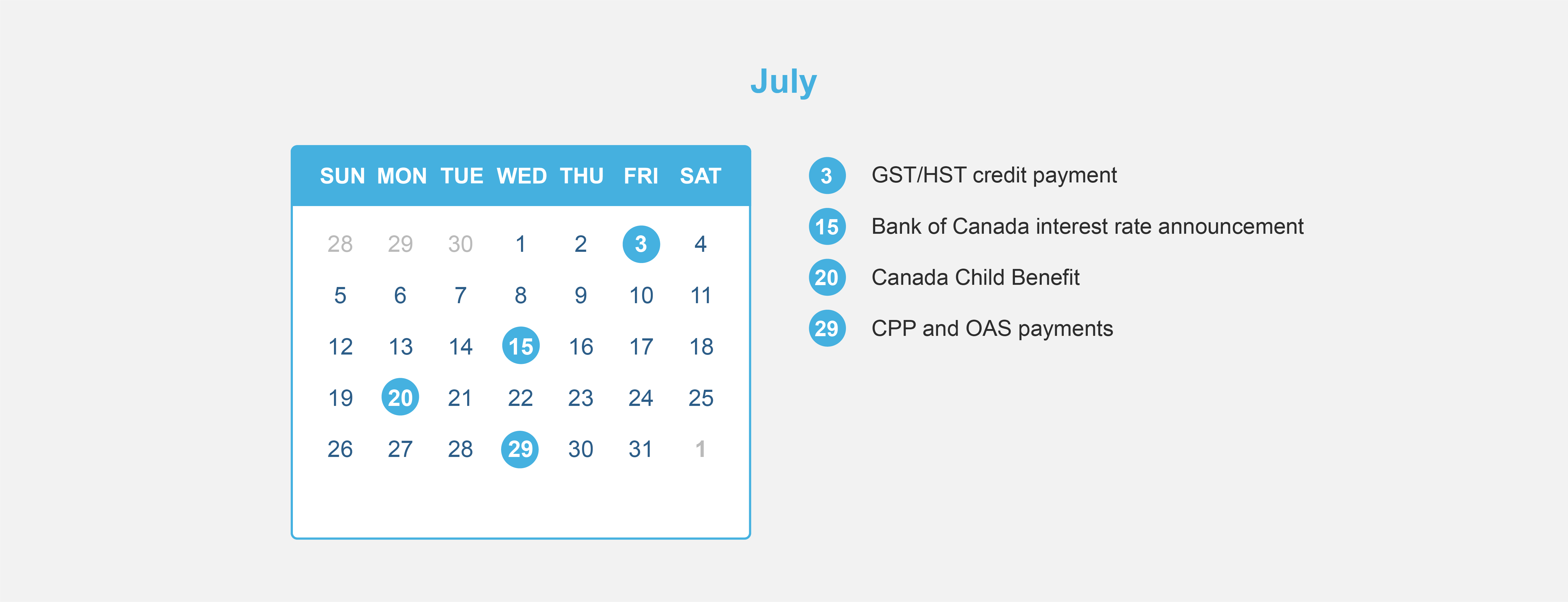

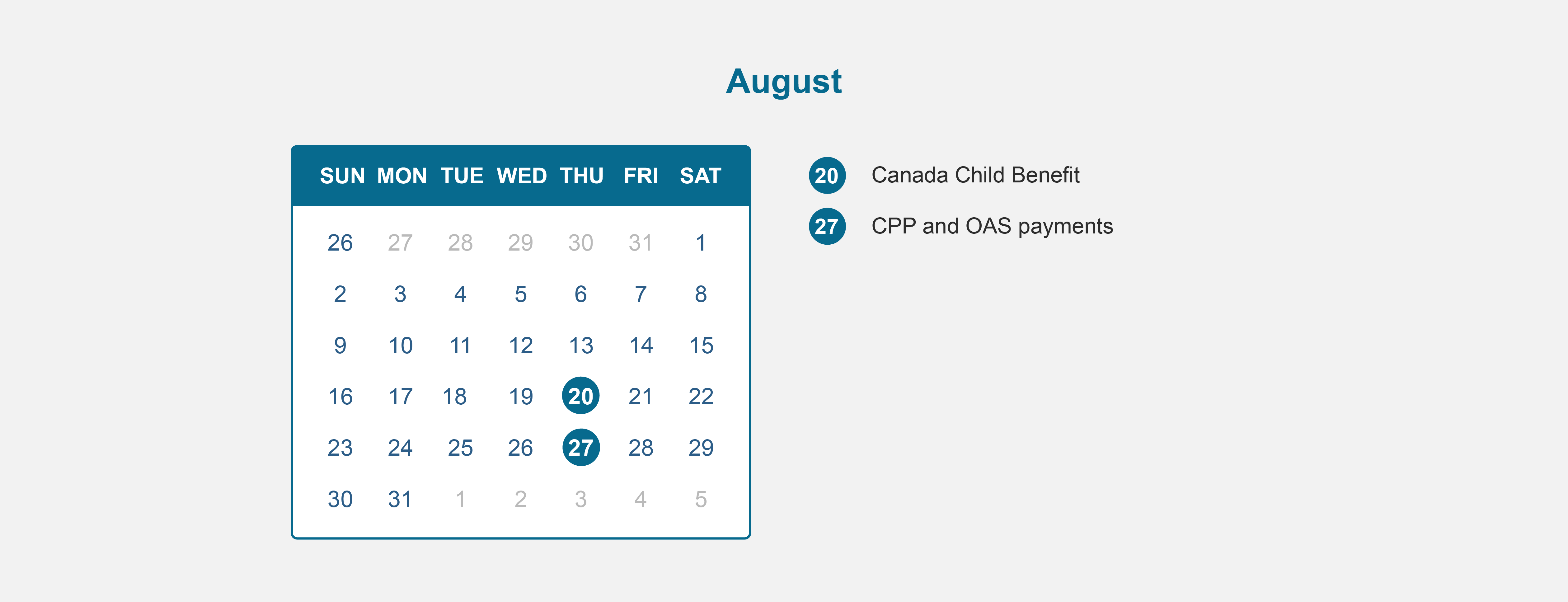

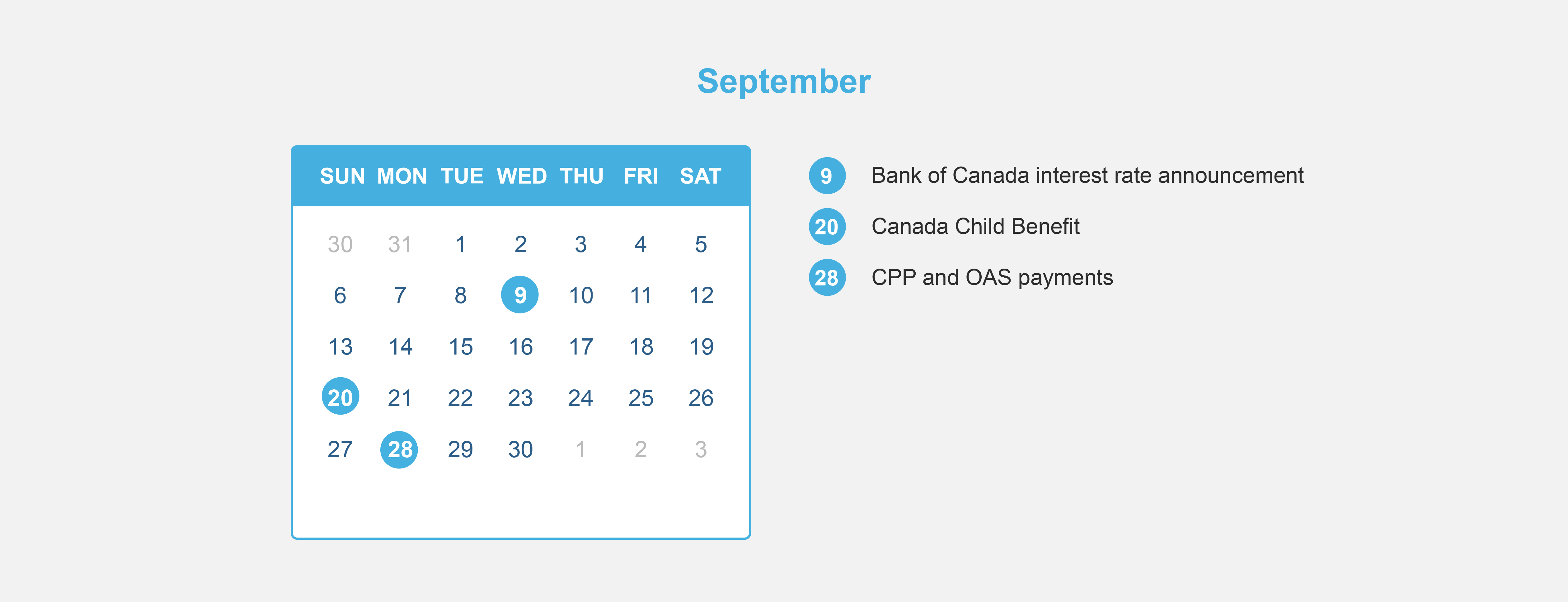

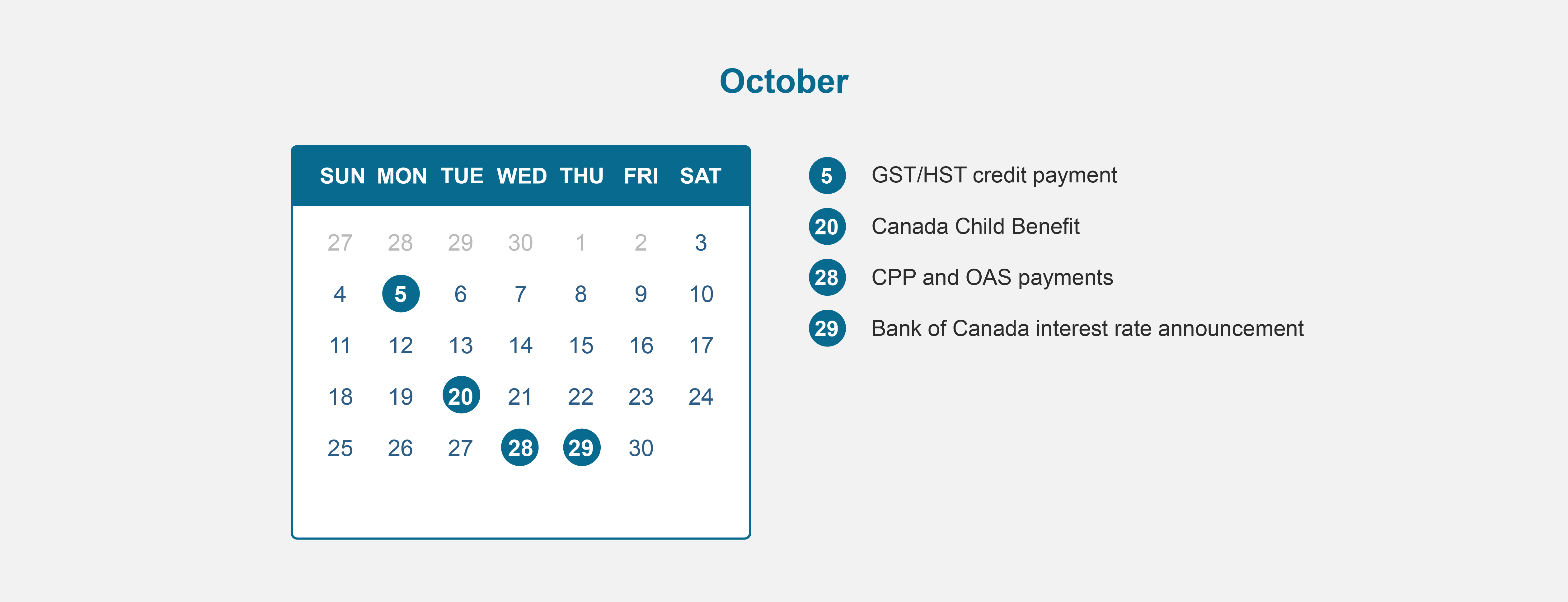

Financial Calendar for 2020 – All the dates you need to know to maximize your benefits!

Financial Calendar for 2020 – All the dates you need to know to maximize your benefits!

Now that we are nearing year end, it’s a good time to review your finances. With the federal election over and no major tax personal tax changes for this year, 2019 is a good year to make sure you are effectively tax planning. Below, we have listed some of the key areas to consider and provided you with some useful guidelines to make sure that you cover all of the essentials. We have divided our tax planning tips into 4 sections:

Tax deadlines

Family tax issues

Managing your investments

Retirement planning

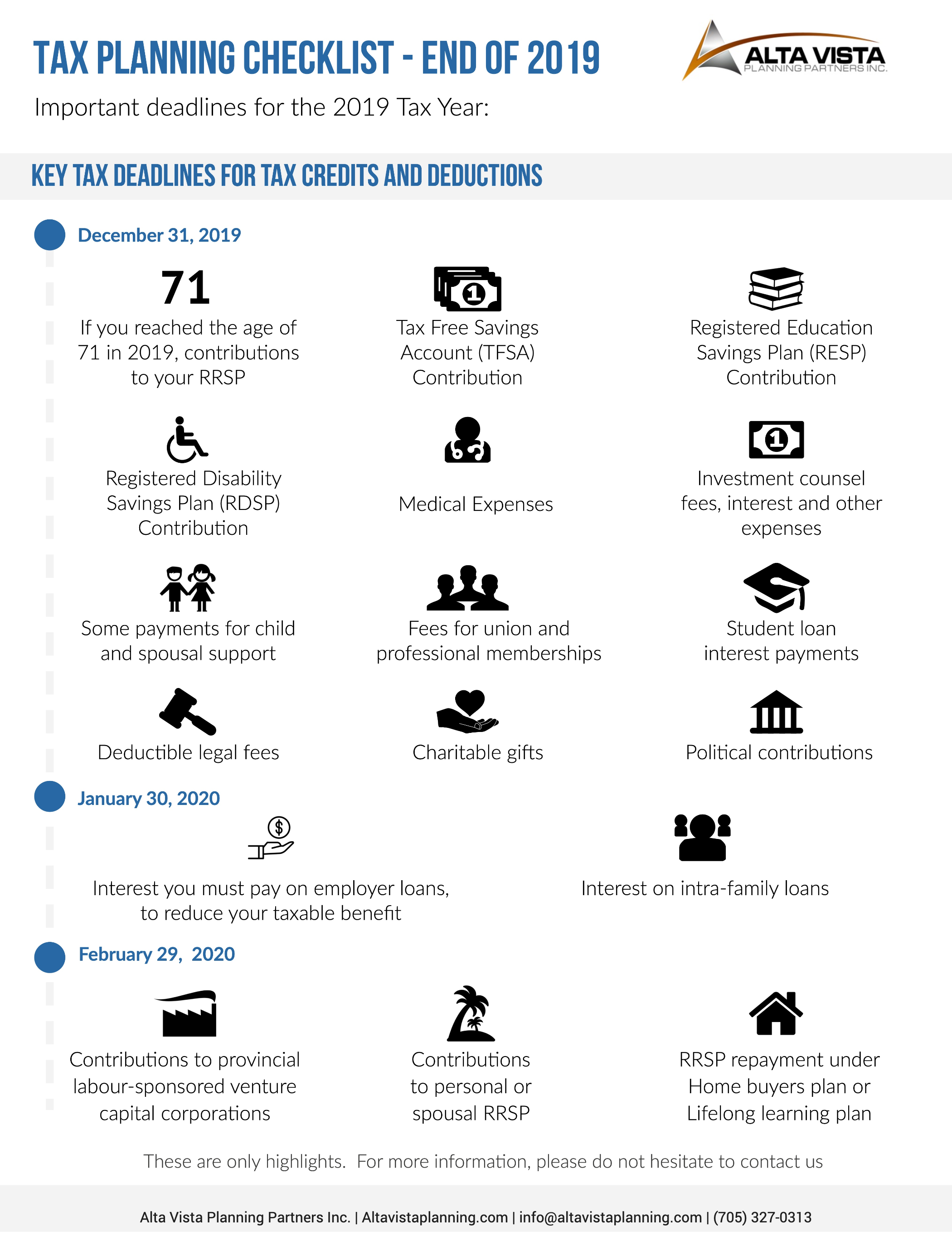

If you reached the age of 71 in 2019, contributions to your RRSP

Use up your TFSA contribution room

Contribute to RESP to get the Canadian education savings grant and the income-tested Canada learning bond.

Contribute to RDSP to get the Canada disability savings grant and the income-tested Canada disability savings bond.

Medical expenses

Investment counsel fees, interest and other expenses relating to investments

Some payments for child and spousal support

Fees for union and professional memberships

Student loan interest payments

Deductible legal fees

Charitable gifts

Political contributions

Interest on intra-family loans

Interest you must pay on employer loans, to reduce your taxable benefit

Contributions to provincial labour-sponsored venture capital corporations

Deductible contributions to a personal or spousal RRSP

RRSP Repayment under Home Buyers Plan or Lifelong Learning Plan

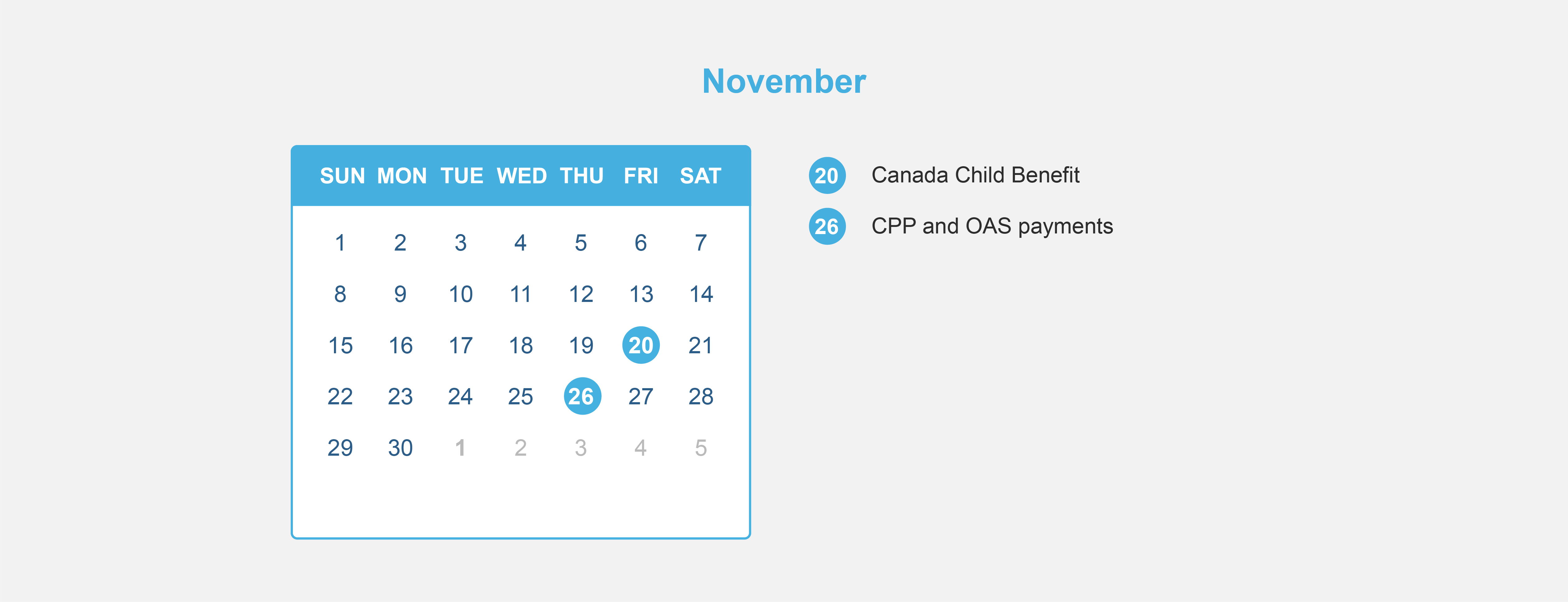

Check your eligibility to the Canada Child Benefit

In order to receive the Canada Child Benefit in 2020/21, you need to file your tax returns for 2019 because the benefit is calculated using the family income from the previous year. Eligibility depends on set criteria such as your family’s income and the number and age of your children and you may qualify for full or partial amount.

Consider family income splitting

The CRA offers a low interest rate on loans and it therefore makes sense to consider setting up an income splitting loan arrangements with members of your family, whereby you can potentially lock in the family loan at a low interest rate of 2% and subsequently invest the borrowed monies into a higher return investment and benefit from the lower tax status of your family member. Don’t forget to adhere to the Tax on Split Income rules.

Contribute to Registered Education Savings Plan (RESP)

The Registered Education Savings Plan (RESP) is a savings plan for parents and others to save for a child’s education. The Canada education savings grant (CESG) will match up to 20% of contributions up to $2,500. That means the CESG can add a maximum of $500 to an RESP each year. Grant room accumulates until the child turns 17, therefore unused basic CESG amounts for the current year are carried forward for possible use in the future years. The income-tested Canada learning bond (CLB) is paid directly to the RESP by the Canadian government to low-income families. There are no personal contributions required to receive the CLB.

Contribute to Registered Disability Savings Plan (RDSP)

The Registered Disability Savings Plan (RDSP) is a savings plan for parents and others to save for the financial security of a person who is eligible for the disability tax credit (DTC). The Canada disability savings grant will pay matching grants of 300%, 200% or 100% depending on the beneficiary’s adjusted family net income and amount contributed. The income-tested Canada disability savings bond is paid directly to the RDSP by the Canadian government to low- income Canadians with disabilities. Before December 31 of the year you turn 49 years old, you can carry forward up to 10 years of unused grant and bond entitlements to future years, as long as you met the eligibility requirements during the carry forward years.

Use up your TFSA contribution room

If you are able, it’s worth contributing the full $6,000 to your TFSA for 2019. You can also contribute more (up to $63,500) if you are 28 or older and haven’t made any previous TFSA contributions.

Contribute to Registered Education Savings Plan (RESP)

The Registered Education Savings Plan (RESP) is a savings plan for parents and others to save for a child’s education. The Canada education savings grant (CESG) will match up to 20% of contributions up to $2,500. That means the CESG can add a maximum of $500 to an RESP each year. Grant room accumulates until the child turns 17, therefore unused basic CESG amounts for the current year are carried forward for possible use in the future years. The income-tested Canada learning bond (CLB) is paid directly to the RESP by the Canadian government to low-income families. There are no personal contributions required to receive the CLB.

Contribute to Registered Disability Savings Plan (RDSP)

The Registered Disability Savings Plan (RDSP) is a savings plan for parents and others save for the financial security of a person who is eligible for the disability tax credit (DTC). The Canada disability savings grant will pay matching grants of 300%, 200% or 100% depending on the beneficiary’s adjusted family net income and amount contributed. The income-tested Canada disability savings bond is paid directly to the RDSP by the Canadian government to low- income Canadians with disabilities. Before December 31 of the year you turn 49 years old, you can carry forward up to 10 years of unused grant and bond entitlements to future years, as long as you met the eligibility requirements during the carry forward years.

Donate securities to charity

Make a donation by year end will provide you tax savings. If you donate eligible securities or mutual funds, capital gains tax does not apply, and you can receive a tax receipt for their full market value. Also, the charity gets the full value of the securities.

Think about selling any investments with unrealized capital losses

It might be worth doing this before year-end in order to apply the loss against any net capital gains achieved during the last three years. Any late trades should ideally be completed on or prior to December 24, 2019 and subsequently confirmed with your broker.

Conversely, if you have investments with unrealized capital gains which are not able to be offset with capital losses, it may be worth selling them after 2019 in order to be taxed on the income the following year.

Consider the timing of purchasing of certain non-registered investments

If you are considering purchasing an interest-bearing investment like a guaranteed investment certificate (GIC) with a maturity date of one year or more, you may consider delaying the purchase to the following year, so you don’t have to pay tax on accrued interest until 2021. You should also consider this with mutual funds that make taxable distributions before the end of 2019, consider delaying this until early 2020. Don’t pay taxes earlier than necessary.

Check if you have investments in a corporation

The new passive investment income rules apply to tax years from 2018. They state that the small business deduction is reduced for companies which are affected with between $50,000 and $150,000 of investment income, therefore the small business deduction has been stopped completely for corporations which earn passive investment income of more than $150,000. At a provincial level, Ontario and New Brunswick have indicated that they are not following the federal rules to limit access to the small business deduction.

Make the most of your RRSP

The deadline for making contributions to your RRSP for the year 2019 is February 29, 2020. There are three things that affect how much you may contribution towards your RRSP, as follows:

18% of your previous year’s earned income

Up to a maximum of $26,500 for 2019 and $27,230 for 2020

Your pension adjustment

Remember that deducting your RRSP contribution reduces your after-tax cost of making said contribution.

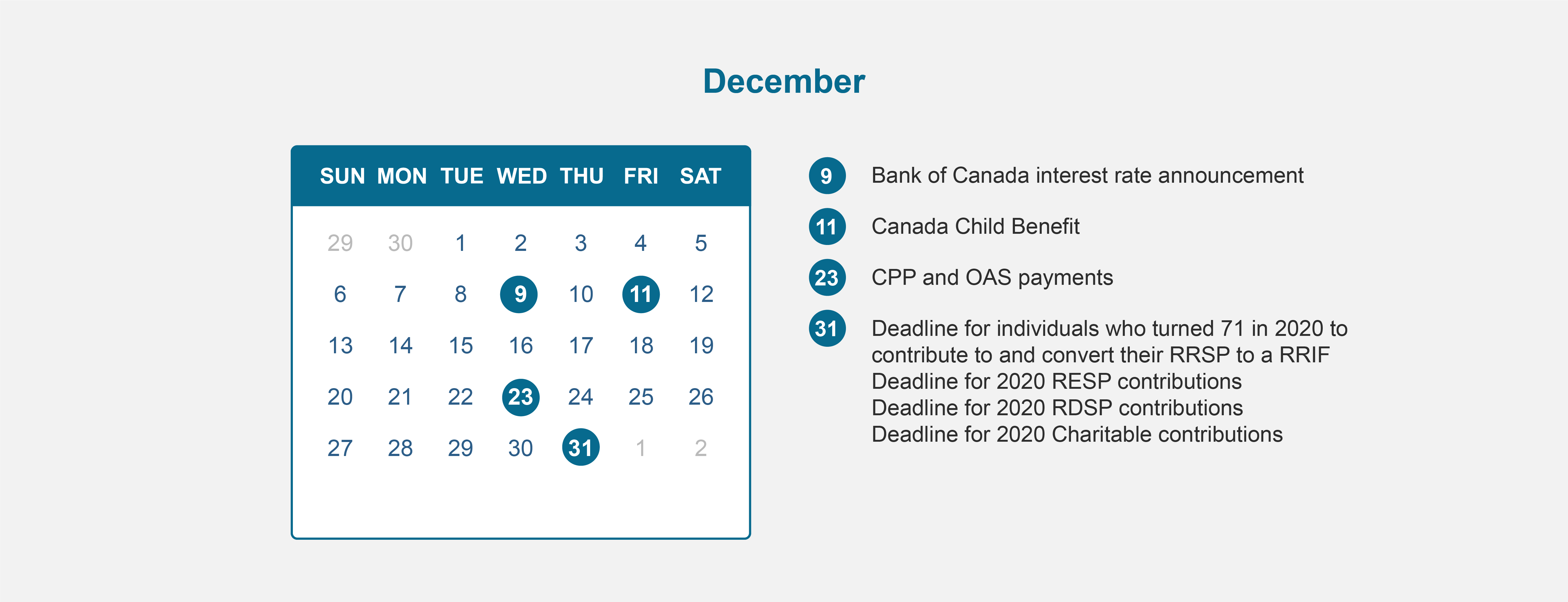

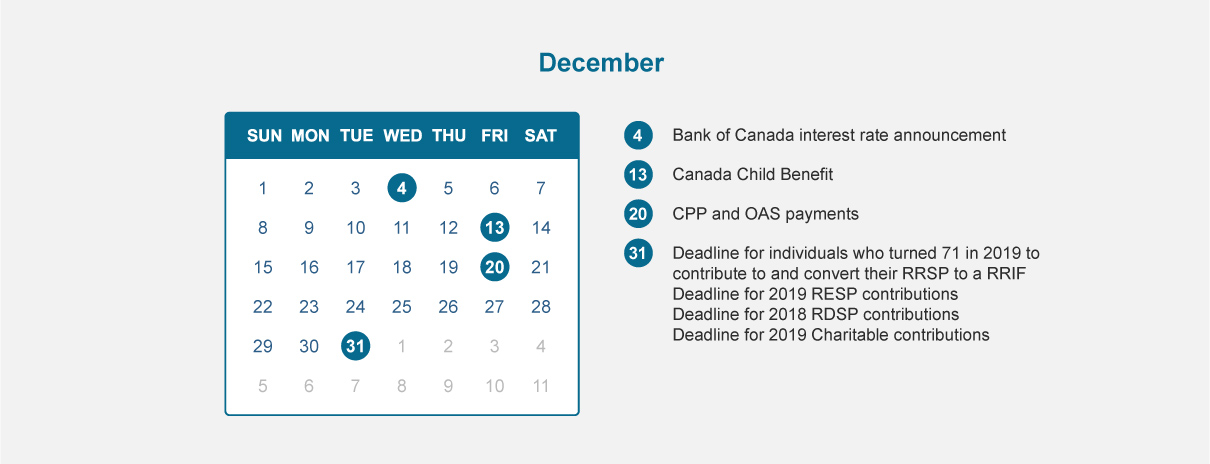

Check when your RRSP is due to end

You should wind-up your RRSP if you reached the age of 71 during 2019 and your final contributions should be made by December 31, 2019.

Convert to RRIF before year end

If you’re 65 or older in the year, you’re entitled to a pension credit that can fully or partly offset the tax on the first $2,000 of eligible income annually. Consider setting up a RRIF before year-end to pay out $2,000 annually if you don’t have any other eligible pension income.

Contact us if you have any questions, we can help.

As a business owner, one of your challenges is learning how to balance between reinvesting into the business and setting money aside for personal savings. Since there are no longer employer-sponsored pension plans and the knowledge that retirement will come eventually, it’s important to have a retirement plan in place.

We’ve put together an infographic checklist that can help you get started on this. We know this can be a difficult conversation so we’re here to help and provide guidance to help you achieve your retirement dreams.

Income Needs

Determine how much income you will need in retirement.

Make sure you account for inflation in your calculations.

Debts

You should try to pay off your debts as soon as you can; preferably before you retire.

Insurance

As you age, your insurance needs change. Review your insurance needs, in particular your medical and dental insurance because a lot of plans do not provide health plans to retirees.

Review your life insurance coverage because you may not necessarily need as much life insurance as when you had dependents and a mortgage, but you may still need to review your estate and final expense needs.

Prepare for the unexpected such as a critical illness or a need for long-term care.

Government Benefits

Check what benefits are available for you upon retirement.

Canada Pension Plan- decide when would be the ideal time to apply and receive CPP payments. Business owners are in a unique position to control how much can be contributed to CPP by deciding to pay salary or dividends. (Dividends don’t trigger CPP contributions.)

Old Age Security- check pension amounts and see if there’s a possibility of clawback.

Guaranteed Income Supplement- if your income is low enough, you could apply for GIS.

Income

Are you a candidate for an individual pension plan (IPP)? IPPs can provide higher contributions than typically permitted to an RRSP and the ability to create a lifelong pension.

Check if your business is a candidate for a group RRSP or company pension plan. This is a great way for you to build retirement savings and provide benefits for your employees and business too.

Make sure you are saving on a regular basis towards retirement- in an RRSP, TFSA, or non-registered. Since you can control how you get paid, salary or dividends, dividends are not considered eligible income to create RRSP room, therefore you should make sure you have the optimal mix of both to achieve your financial goals.

Ensure your investment mix makes sense for your situation.

Don’t forget to check if there are any other income sources. (ex. rental income, side hustle income, etc.)

Assets

The sale of your business can be part of your retirement nest egg. Therefore, you should make sure you know the valuation of your business and your plan to sell the business to your family, employees, partners or a third party. You should also know when you decide to sell your business too.

Are you planning to use the sale of your home or other assets to fund your retirement?

Will you be receiving an inheritance?

One other consideration that’s not included in the checklist is divorce. This can be an uncomfortable question, however divorce amongst adults ages 50 and over is on the rise and this can be financially devastating for both parties.

Contact Us about helping you get your retirement planning in order so your retirement dreams can be achieved.

Many business owners have built up earnings in their corporation and are looking for tax efficient ways to pull the earnings out to achieve their personal and business financial goals such as:

building and protecting your savings

providing for loved ones

planning for retirement

What’s the purpose of the investment? First, think about what you’ll be doing with your savings. This will help dictate what savings vehicle is best suited for your situation. Then consider the following factors:

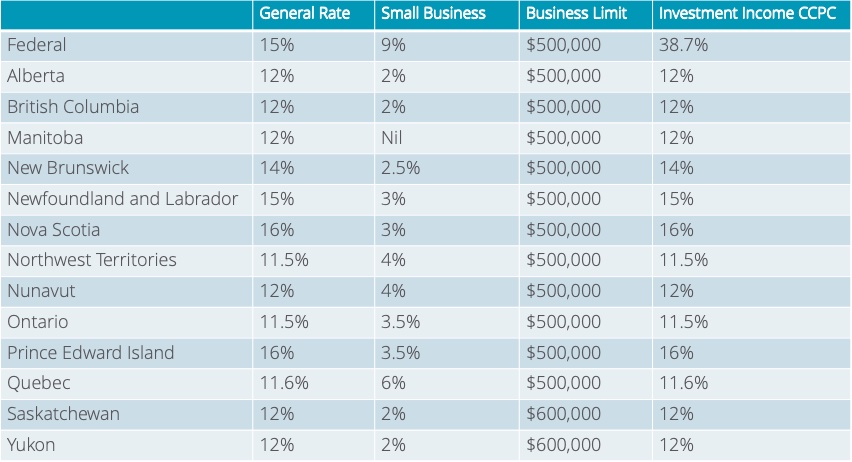

Taxes: As a small business owner, you have access to the small business tax rate which is typically lower than your personal tax rate. (See table below.) Also, as of January 1, 2019, the Federal Budget decreased the small business limit for corporations with a set threshold of income generated from passive investments.

2019 Corporate Income Tax Rates

Taxes on investment growth: Depending on what you invest in, you will want to review this as different asset types are taxed at different rates.

Timing: You can control the timing of the payout which means you could potentially defer paying out the money until you need it and determine if you’d like to pay it out as salary or dividend.

Creditor Protection: Sometimes, investments held inside a corporation can be vulnerable to creditors, therefore you may want to consider using a holding company or trust or pay out money to yourself personally. This can be complex and requires professional advice.

Capital Gains Exemption: If your investment grows too large, it may endanger your qualification for the lifetime capital gains exemption that ‘s available when shares of a qualified small business corporation are sold or transferred.

For business owners, before investing personally or corporately, it’s certainly worth seeking professional advice to ensure that it suits your individual circumstances.

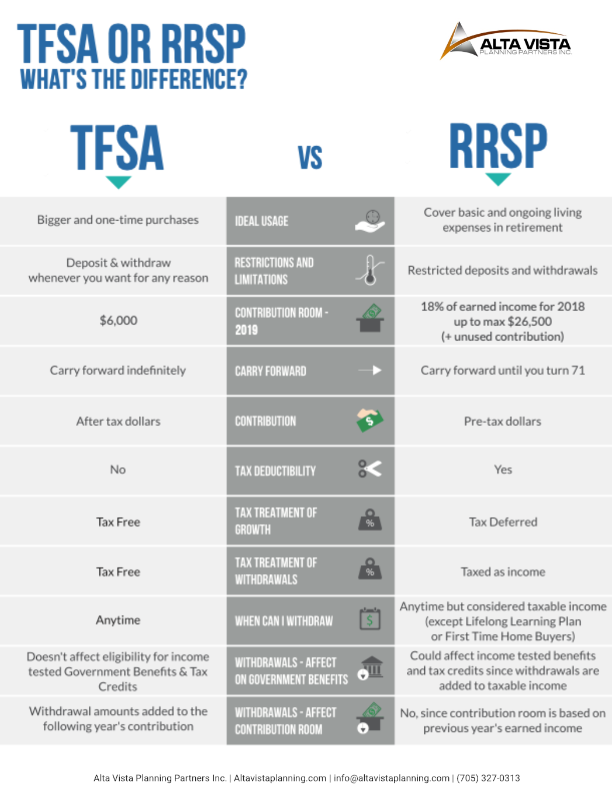

If you are seeking ways to save in the most tax-efficient manner available, TFSAs and RRSPs can both be effective options for you to achieve your savings goals more quickly. However, each plan does have distinct differences and advantages / disadvantages. Let’s take a look at their key features:

While a TFSA can be used for any type of savings, an RRSP is used exclusively for retirement savings.

You can enjoy tax free withdrawals from your TFSA due to the fact that you make your contributions after you have paid tax, whereas the opposite is true for withdrawals from your RRSP (except in the case of lifelong learning plan and home buyers’ plan)

TFSA contributions aren’t tax deductible whereas RRSP contributions are i.e. with an RRSP, you can deduct the contributions that you make from your income when you file your tax return.

It is required that you use earned income to contribute towards your RRSP but this is not the case for your TFSA.

You can continue to contribute towards your TFSA for as long as you like, whereas you must close your RRSP and stop contributing towards it when you turn 71 and purchase an annuity or convert it to a RRIF with the savings that you have made within the plan.

You are able to specify your spouse as your beneficiary with both your TFSA and your RRSP, however there is a key difference with how your savings are treated upon your spouse’s death. With an RRSP, there will be taxes payable upon the monies left in the plan by your children who inherit it, whereas with a TFSA, tax is only paid on the increase in the value of the plan since the date of death in the year that it is inherited by your children. What’s more, no tax is payable if the value that they receive is less than the value of the TFSA at the time of death.

In summary, your individual circumstances will dictate which plan is the most appropriate for you, depending on your tax position and withdrawal intentions. The primary difference between both plans is the timing of the taxes payable i.e. if you want to defer the payment of your taxes, particularly if your marginal tax rate will be lower in retirement, an RRSP may be more beneficial for you. Alternatively, if your marginal tax rate will be higher when you plan to make withdrawals, a TFSA may suit you better.

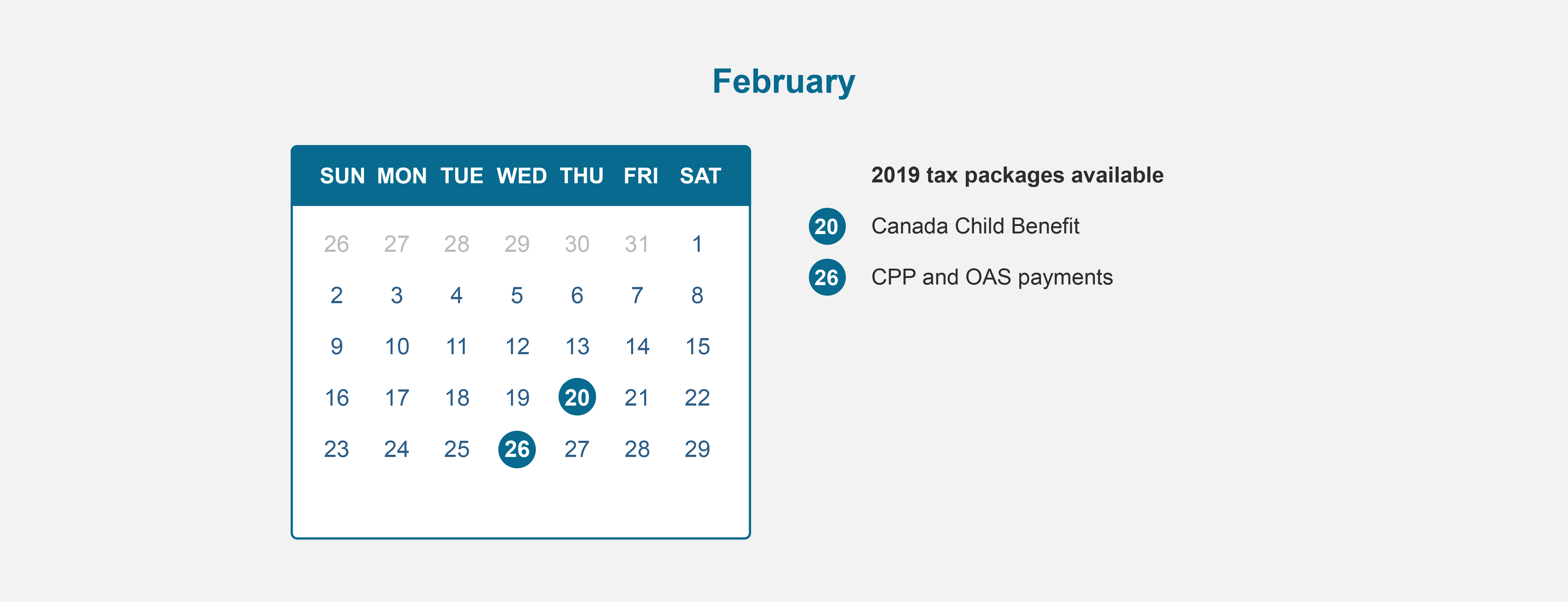

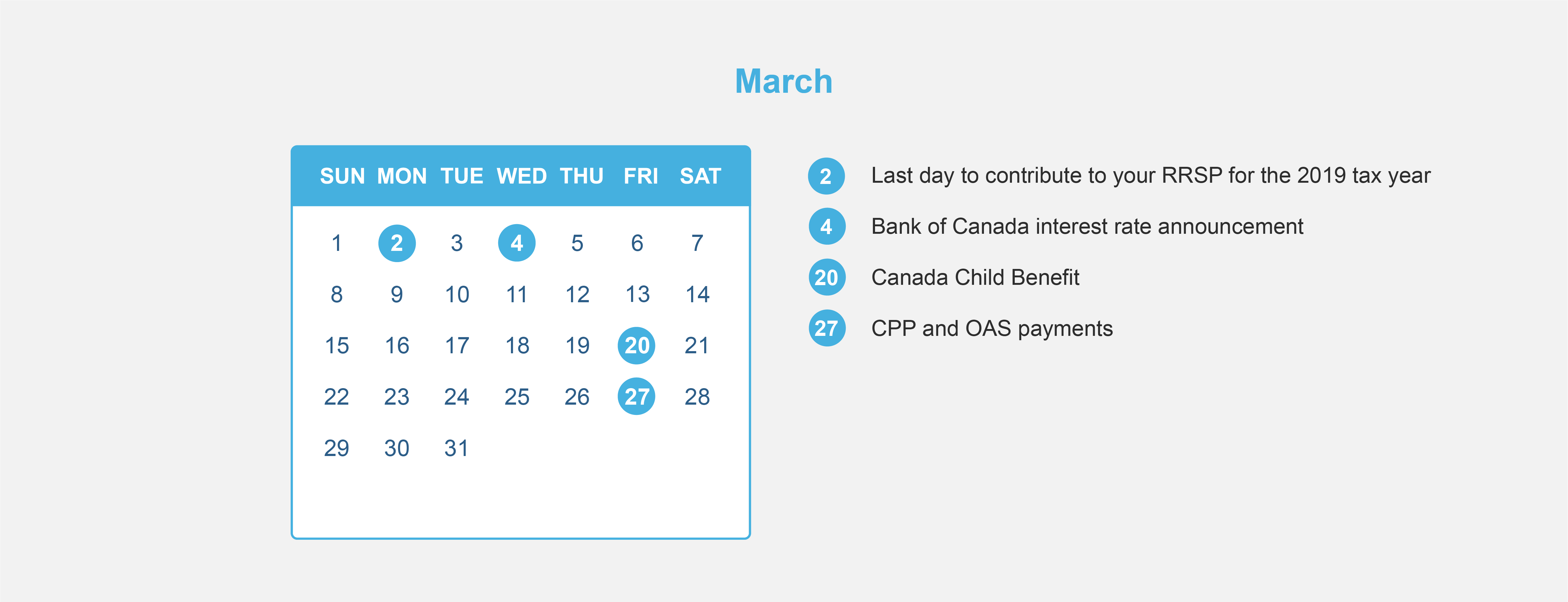

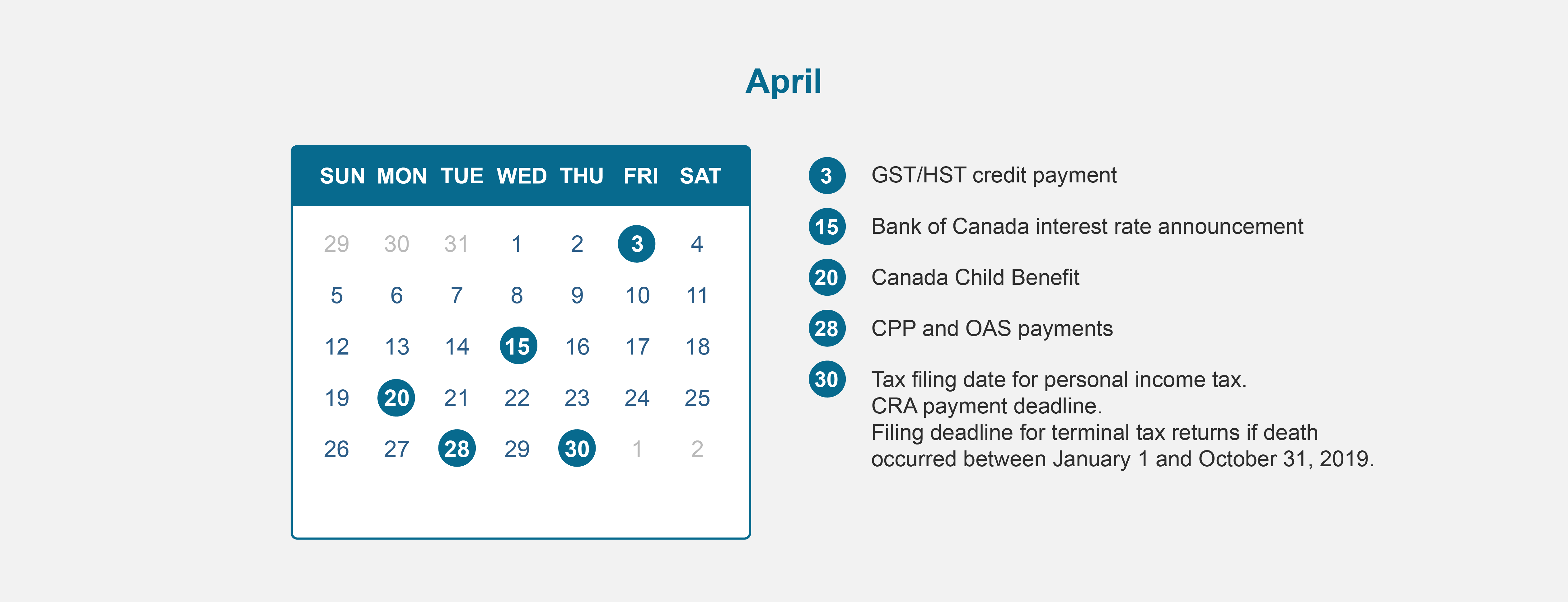

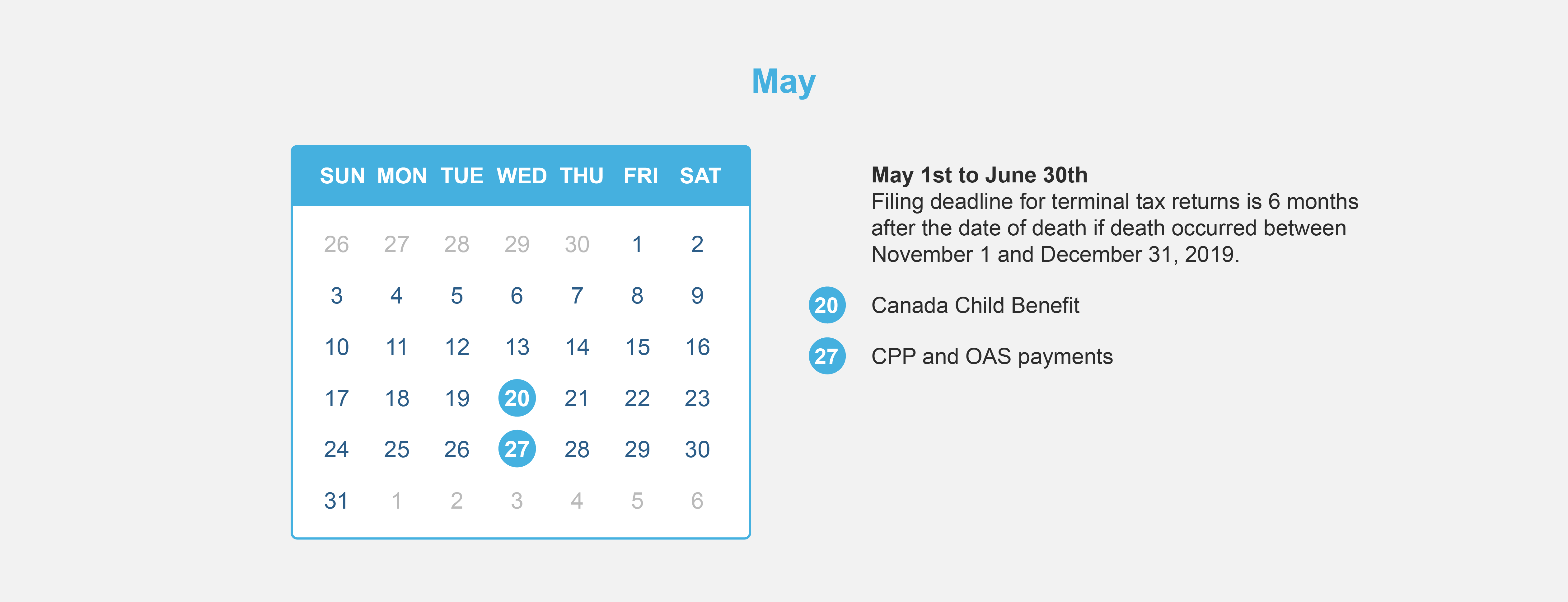

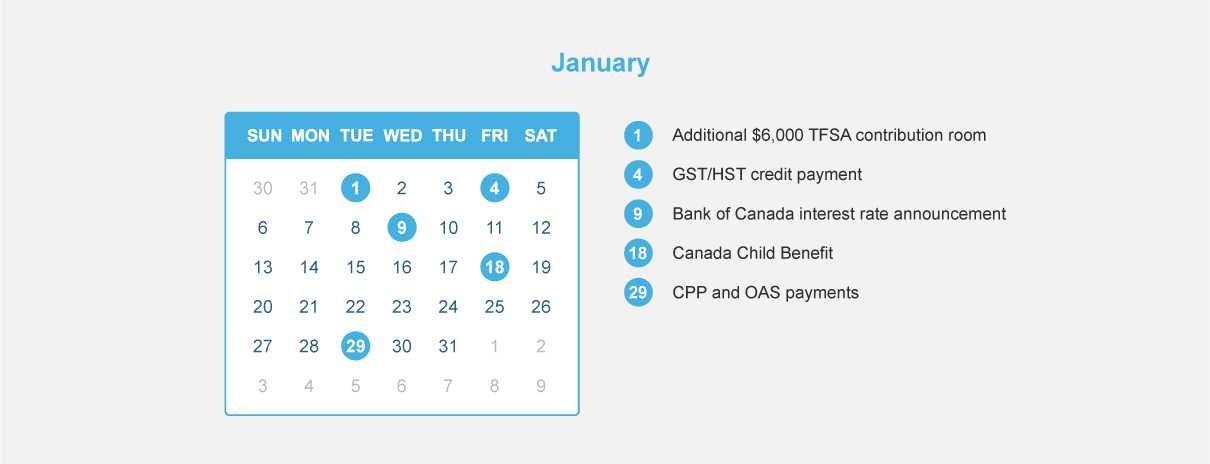

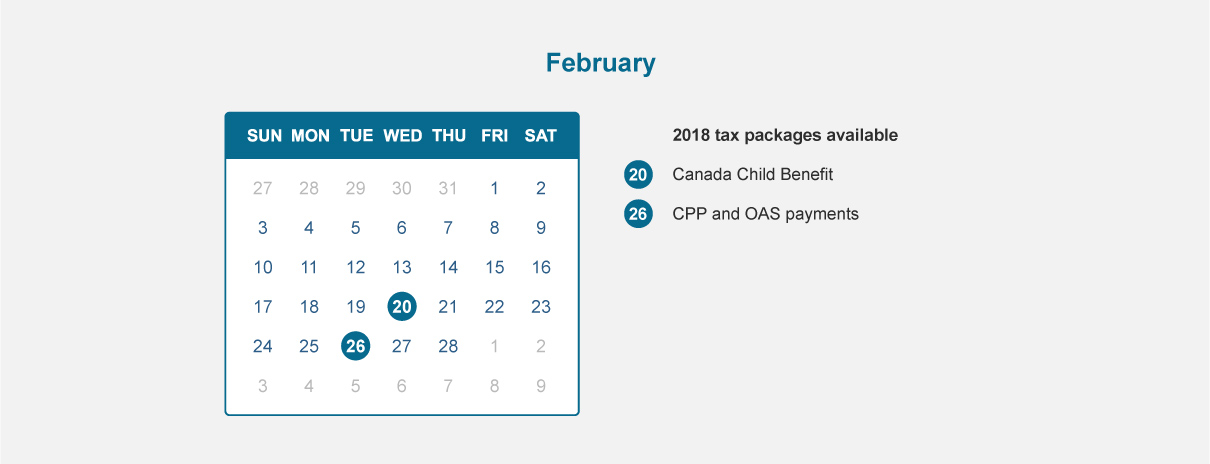

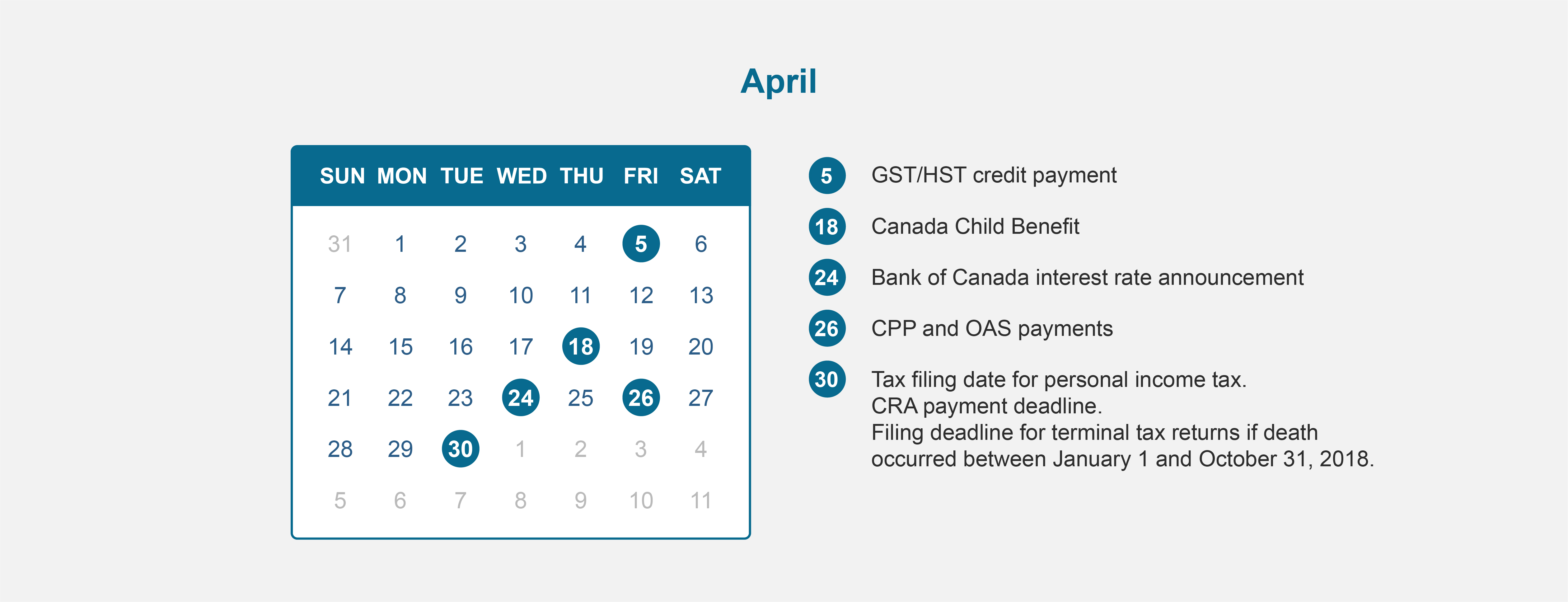

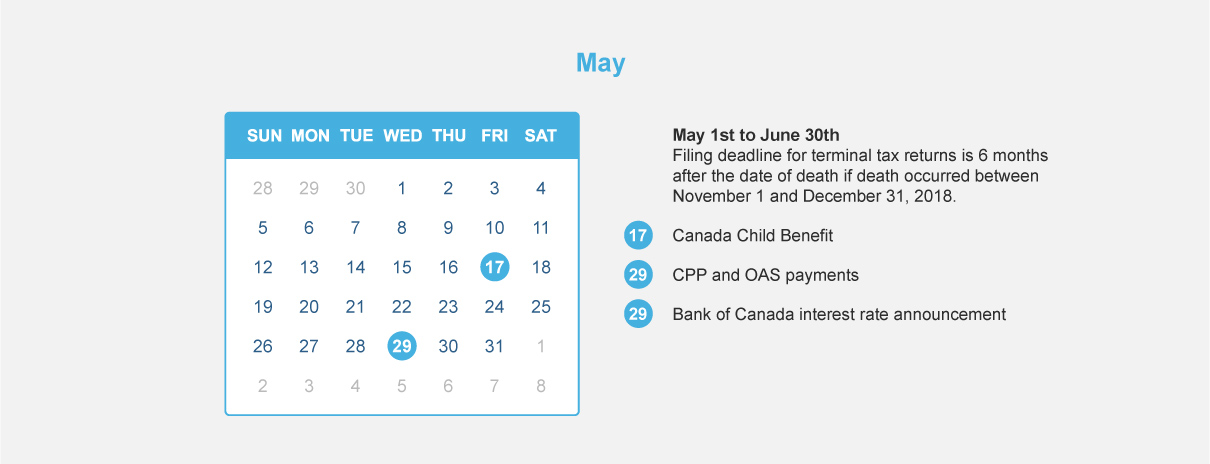

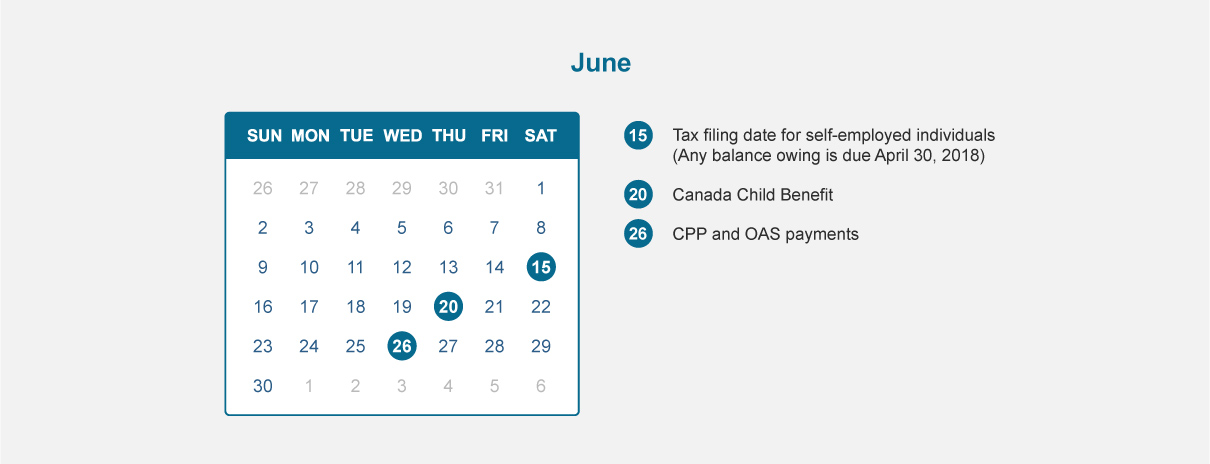

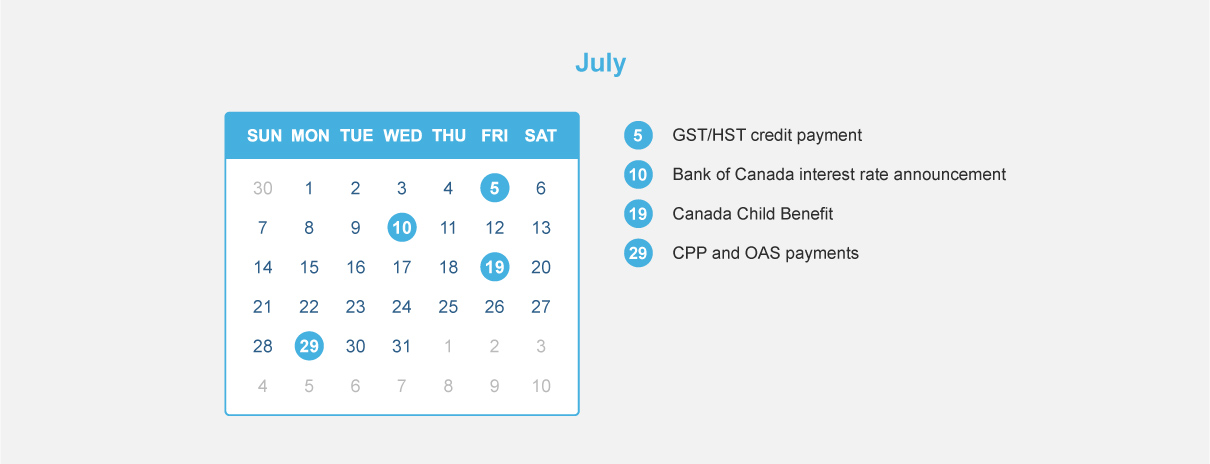

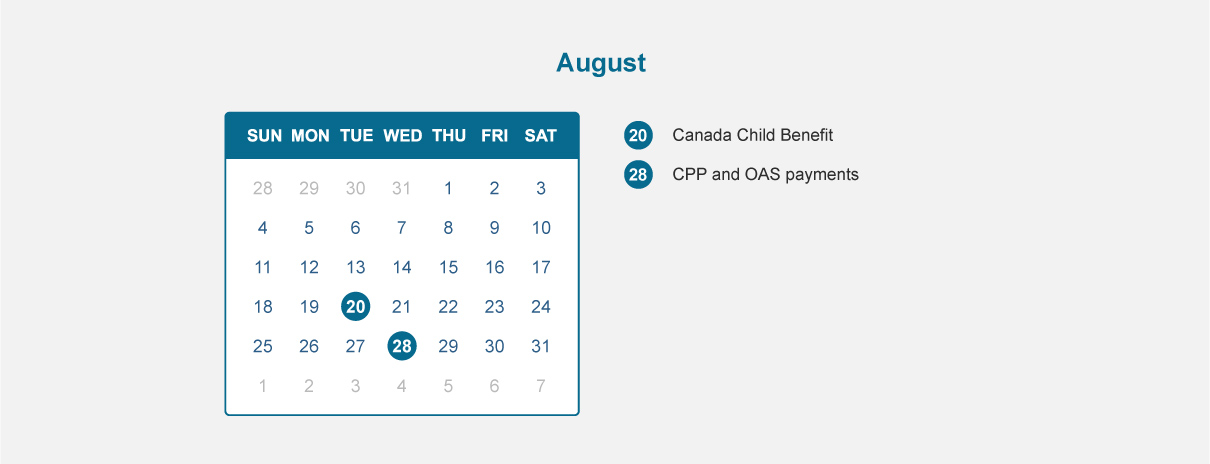

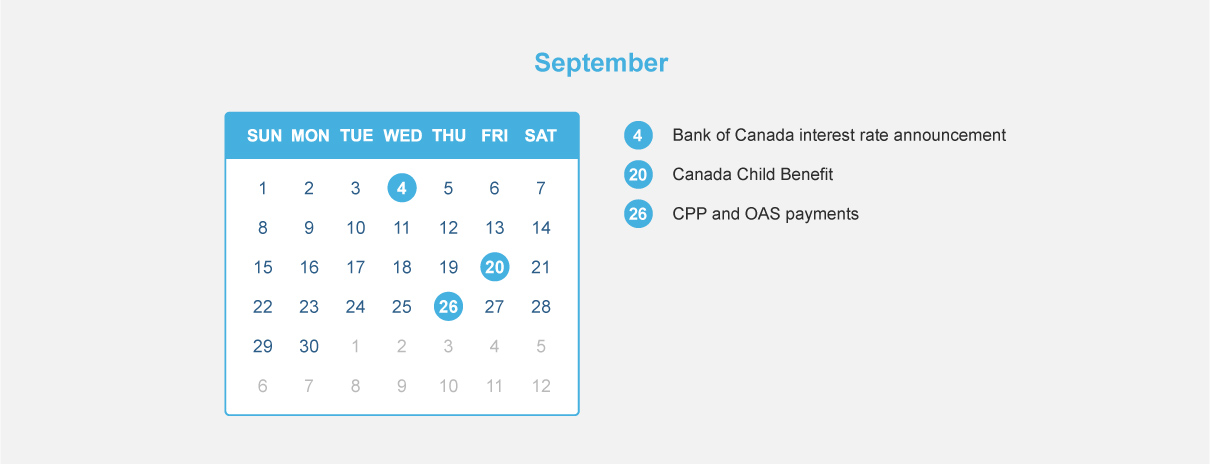

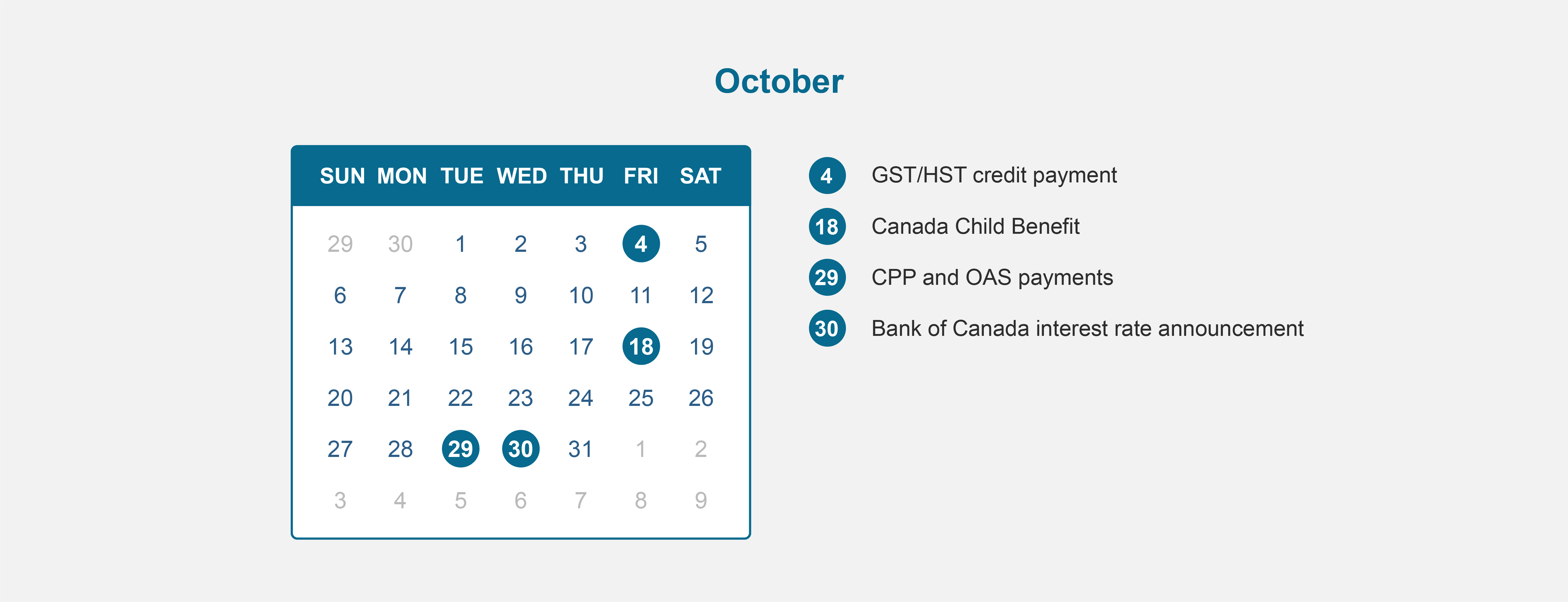

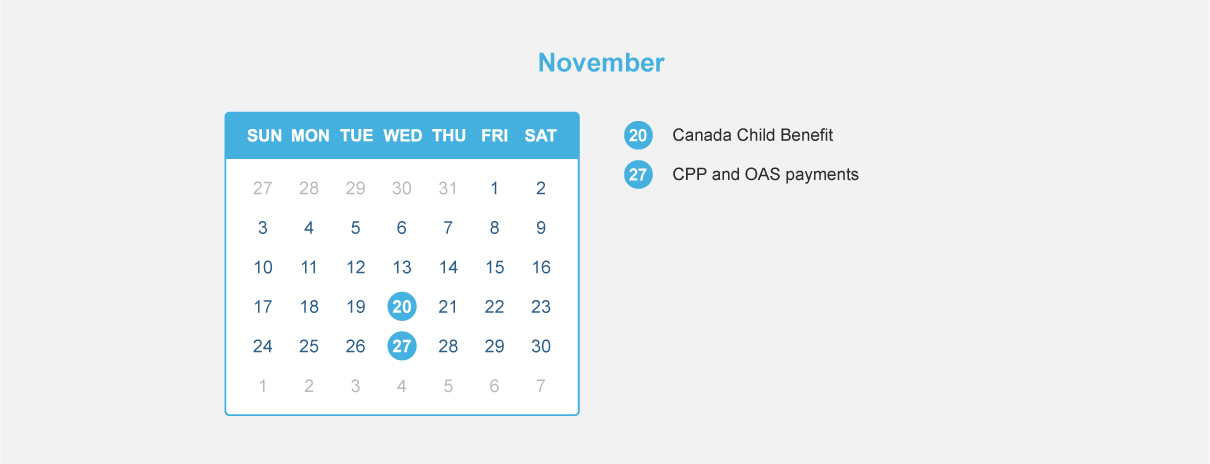

Financial Calendar for 2019 – All the deadlines you need to know to maximize your benefits!

Now that we are nearing year end, it’s a good time to review your finances. 2018 saw a number of major changes to tax legislation come in force and more will apply in 2019, therefore you should consider available opportunities and planning strategies prior to year-end.

Below, we have listed some of the key areas to consider and provided you with some useful tips to make sure that you cover all of the essentials.

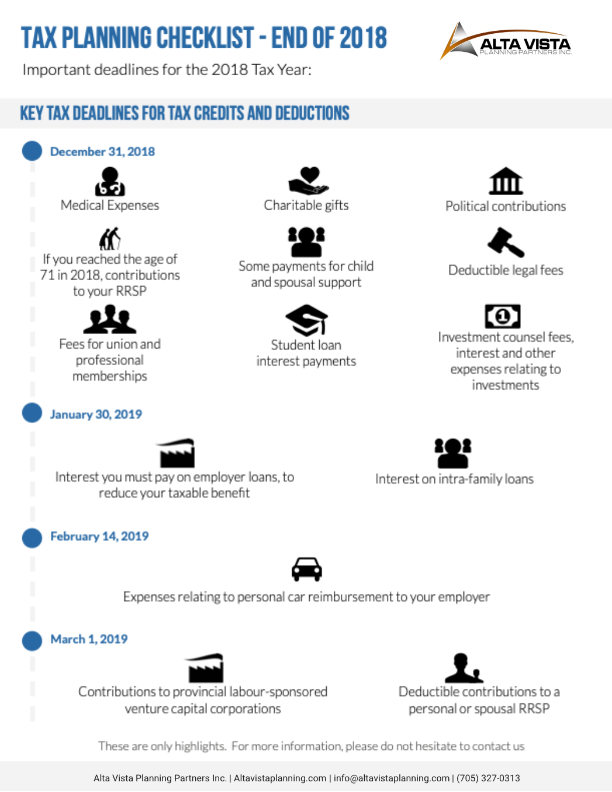

December 31, 2018:

Medical expenses

Fees for union and professional memberships

Charitable gifts

Investment counsel fees, interest and other expenses relating to investments

Student loan interest payments

Political contributions

Deductible legal fees

Some payments for child and spousal support

If you reached the age of 71 in 2018, contributions to your RRSP

January 30, 2019

Interest on intra-family loans

Interest you must pay on employer loans, to reduce your taxable benefit

February 14, 2019

Expenses relating to personal car reimbursement to your employer

March 1, 2019

Contributions to provincial labour-sponsored venture capital corporations

Deductible contributions to a personal or spousal RRSP

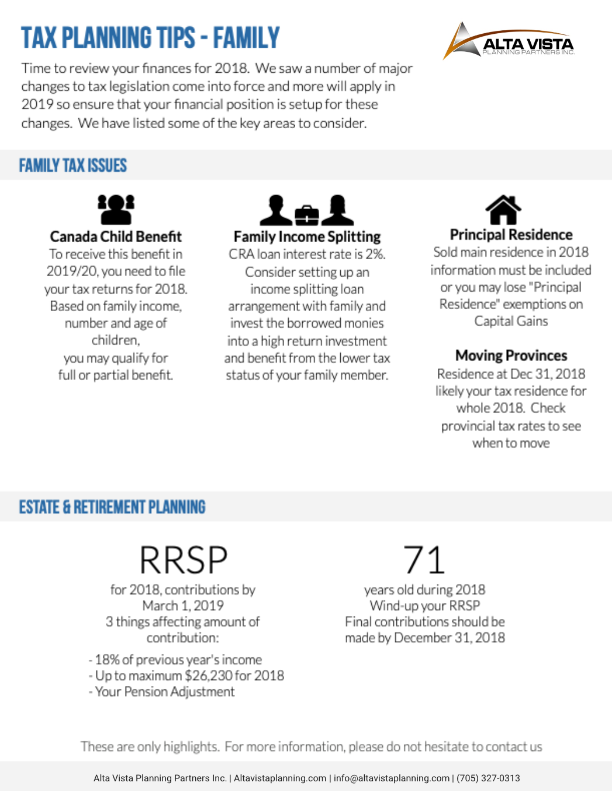

Check your eligibility to the Canada Child Benefit

In order to receive the Canada Child Benefit in 2019/20, you need to file your tax returns for 2018 because the benefit is calculated using the family income from the previous year. Eligibility depends on set criteria such as your family’s income and the number and age of your children and you may qualify for full or partial amount.

Consider family income splitting

The CRA offers a low interest rate on loans and it therefore makes sense to consider setting up an income splitting loan arrangements with members of your family, whereby you can potentially lock in the family loan at a low interest rate of 2% and subsequently invest the borrowed monies into a higher return investment and benefit from the lower tax status of your family member. Don’t forget to adhere to the new Tax on Split Income rules.

Have you sold your main residence this year?

If so, your 2018 personal tax return must include information regarding the sale or you may lose any “principal residence” exemptions on the capital gains from the sale and thus make the sale taxable.

If you’re moving, think carefully about your moving date

If you are moving to a new province, it’s worth noting that your residence at December 31, 2018 is likely to be the one that your taxes are due to for the whole of the 2018 year. Therefore, if your move is to a province with higher taxes, putting your move off until 2019 may therefore make sense, and vice versa if you are moving to a lower tax province.

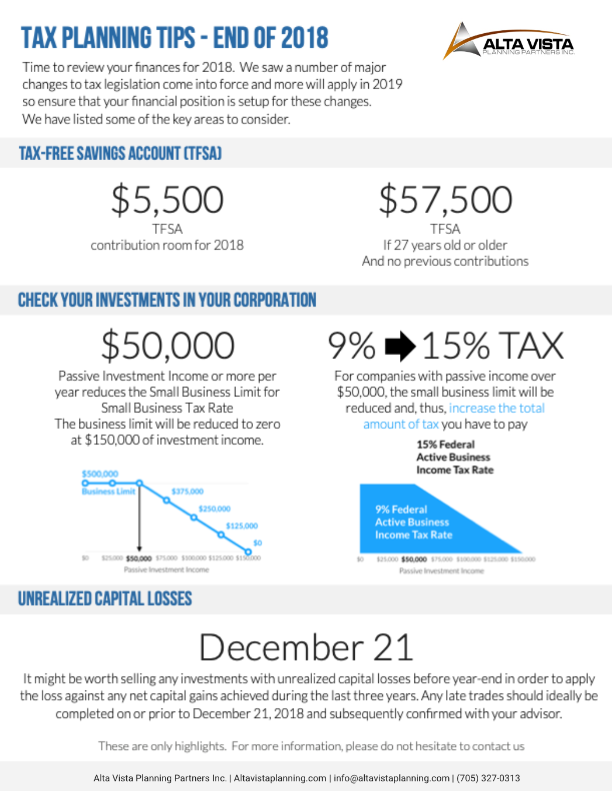

Use up your TFSA contribution room

If you are able, it’s worth contributing the full $5,500 to your TFSA for 2018. You can also contribute more (up to $57,500) if you are 27 or older and haven’t made any previous TFSA contributions.

Check if you have investments in a corporation

The new passive investment income rules apply to tax years from 2018 and you therefore need to plan ahead if the rules affect you. They state that the small business deduction is reduced for companies which are affected with between $50,000 and $150,000 of investment income, therefore the small business deduction has been stopped completely for corporations which earn passive investment income of more than $150,000.

Think about selling any investments with unrealized capital losses

It might be worth doing this before year-end in order to apply the loss against any net capital gains achieved during the last three years. Any late trades should ideally be completed on or prior to December 21, 2018 and subsequently confirmed with your broker. Conversely, if you have investments with unrealized capital gains which are not able to be offset with capital losses, it may be worth selling them after 2018 in order to be taxed on the income the following year.

Make the most of your RRSP

The deadline for making contributions to your RRSP for the year 2018 is March 1, 2019. There are three things that affect how much you may contribution towards your RRSP, as follows:

18% of your previous year’s earned income

Up to a maximum of $26,230 for 2018 and $26,500 for 2019

Your pension adjustment

Remember that deducting your RRSP contribution reduces your after-tax cost of making said contribution.

Check when your RRSP is due to end

You should wind-up your RRSP if you reached the age of 71 during 2018 and your final contributions should be made by December 31, 2018.

Make your personal tax instalments

If you pay your final 2018 personal tax instalment by December 15, 2018, you won’t pay interest or penalty charges. Similarly, if you are behind on these instalments, you should try to make “catch-up” payments by that date. You can also offset part or all of the non-deductible interest that you would have been assessed if you make early or additional instalment payments.

Remember the deadline for making a taxpayer-relief request

The deadline is December 31, 2018 for making a tax-payer relief request related to the 2008 tax year.

Consider how to minimize the taxable benefit for your company car

The taxable benefit applied to company cars is comprised of two parts – a stand-by charge and an operating-cost benefit. If you drive a company car, it’s worth considering how to potentially minimize both of these elements. The taxable benefit for operating costs is $0.26 per km of personal use, therefore you should make sure that you reimburse your employer where relevant, by the deadline of February 14, 2019.

Contact us if you have any questions, we can help.

Working with a professional to help you to make sense of your finances can be a wise move, but for this relationship to work effectively it is important that you understand what to expect from your financial advisor.

What can your financial advisor help you with?

What should your financial advisor inform you of?

What will your financial advisor need from you or need to ask you about?

If you’re looking to achieve your financial goals, talk to us. We can help.

Alta Vista Planning Partners Inc.

Tel: 705-327-0313

Email: info@altavistaplanning.com

359 West St. N 2nd Floor

Orillia, ON

L3V 5E5

Our firm works with business owners and professionals to help them take excellent care of their families and their employees. If you own a small business or professional corporation, let's have a conversation. What matters most to you is what matters most to us!